Google 5-Star Rated Direct Hard Money Lender

What is Cash-Out Refinancing and How Does It Work?

Cash-out refinancing allows you to leverage your property’s equity to take out a loan and can help borrowers quickly access cash and negotiate lower interest rates. Before applying for cash-out refinancing, consider your equity and new loan terms and rates.

Whether you’re a homeowner or real estate investor, getting access to the funds you need to accomplish your financial goals can be difficult. You may not qualify for a traditional loan due to your credit score, income, and other factors.

The good news is there are solutions. Cash-out refinancing is one way to leverage your home equity to get the money you need for anything from a medical emergency to a significant purchase.

Before applying for a cash-out refinancing home loan, it’s essential to understand the pros and cons and compare your loan options. Read on to learn about cash-out refinancing, how it works, and whether it’s right for you.

- What is cash-out refinancing?

- How does cash-out refinancing work?

- Eligibility requirements for cash-out refinancing

- How cash-out refinancing differs from other refinancing options

- Pros and cons of cash-out refinancing

- What to consider before applying for cash-out refinancing

- Cash-Out Refinancing: FAQs

- Is cash-out refinancing right for you?

What is cash-out refinancing?

Cash-out refinancing lets you refinance your mortgage to turn your home equity into cash you can access. When you apply for cash-out refinancing, you can use some of the funds you receive to pay off your existing mortgage and keep the rest as one lump sum. Unlike the money you borrow through other loan programs, you can use the money from cash-out refinancing for any purpose.

How does cash-out refinancing work?

Cash-out refinancing may sound complex, but it’s actually a pretty straightforward process. When you apply for cash-out refinancing, you use your home equity to pay off your mortgage and take out a new loan. After paying off your existing mortgage, the remaining amount will be given to you as a lump sum.

Traditional mortgage refinancing allows you to refinance to change your interest rate and loan terms. While these terms typically change with cash-out refinancing, it offers the added benefit of allowing you to use the money you borrow for any purpose.

Eligibility requirements for cash-out refinancing

Before you apply for cash-out refinancing, you must meet the general eligibility requirements. Here are the requirements you must meet to be eligible for a cash-out refinance:

- Credit score: Lenders examine your credit score and history to ensure you’re a low-risk borrower. If your credit score is too high or you have delinquent accounts, you may not qualify for a loan.

- Home equity: Your home equity determines whether you’re eligible for a cash-out refinance, and most lenders want you to have at least 20-30% equity in your home.

- Loan-to-value (LTV) ratio: The LTV ratio is the percentage of an asset’s purchase price that’s covered by a loan. If you receive a loan of $50,000 to purchase a $100,000 asset, the LTV ratio is 50%.

How cash-out refinancing differs from other refinancing options

In addition to cash-out refinancing, you can use other types of loans and refinancing options to leverage your home equity. Let’s examine how these refinancing options compare to cash-out refinancing.

Rate-and-term refinancing is an option for homeowners who want better loan terms. You’re not taking a loan out based on your home equity — instead, you’re simply negotiating lower interest rates, a shorter loan term, or both.

A home equity loan is another way to borrow money by leveraging your home equity. Your loan amount will be determined by the value of your home and how much equity you have in it. You can choose between a traditional home equity loan or a home equity line of credit (HELOC), which functions like a credit card.

There are various other types of loans you can apply for as a real estate investor, including fix and flip loans and hard money loans for rental properties.

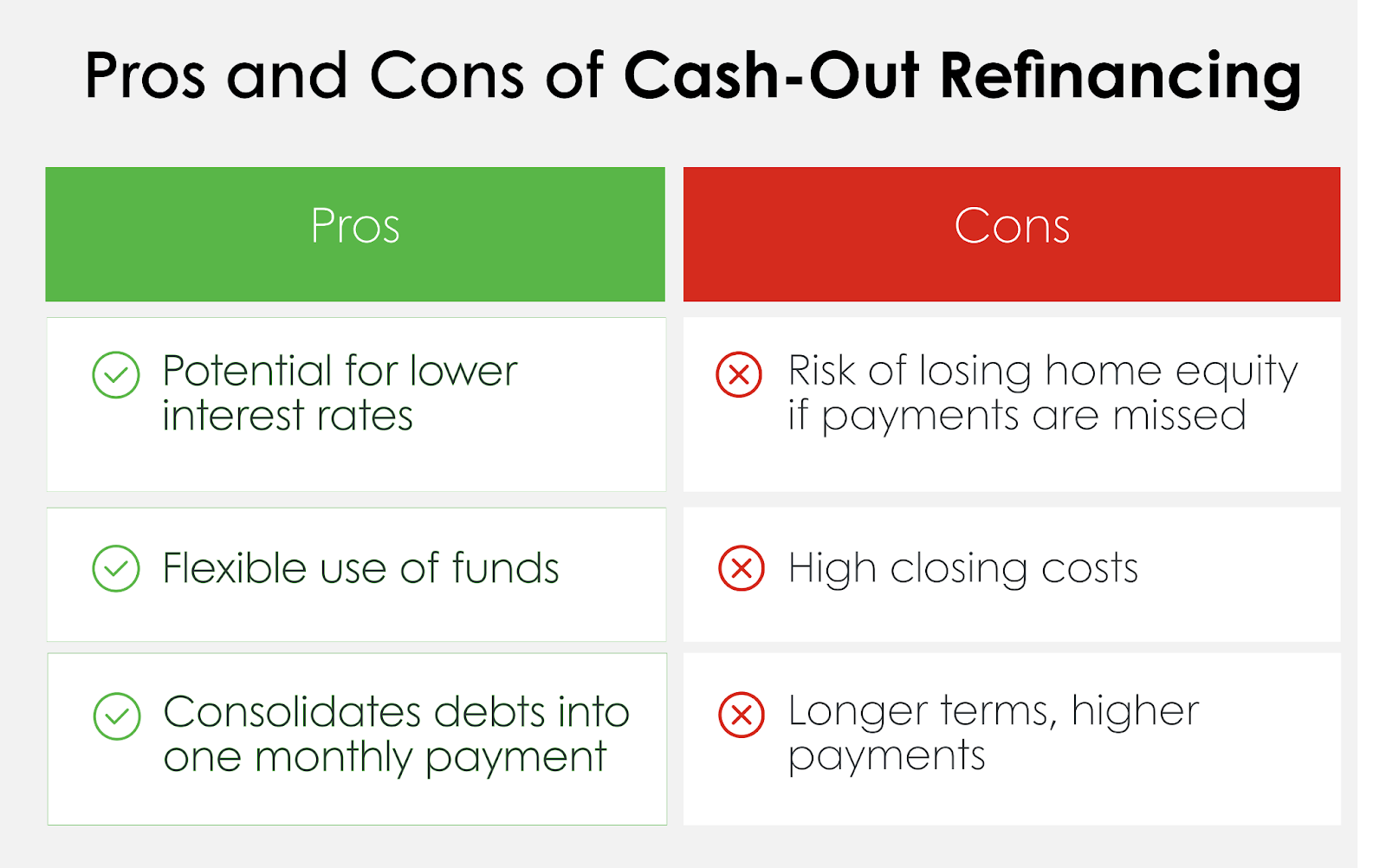

Pros and cons of cash-out refinancing

Before you apply for cash-out refinancing, it’s important to understand the pros and cons compared to other refinancing and hard money loan options. Not sure if a cash-out refinance is right for you? Check out some of the benefits and drawbacks below.

Pros

- Cash-out refinancing may offer lower interest rates than other types of loans, saving you money in the long term.

- If you want to consolidate multiple types of debt into a single payment, you can pay off your debt with cash-out refinancing and make a single monthly payment.

- Funds from cash-out refinancing aren’t designated for a specific purpose, so you can use them for home renovations, emergency bills, or major purchases.

Cons

- You’re putting your home equity at risk if you don’t make on-time payments for the duration of your loan term.

- While a rate-and-term refinance helps you lower your monthly payments and get your mortgage paid off faster, cash-out refinancing can result in longer loan terms and higher monthly payments.

- Cash-out refinancing comes with potentially expensive closing costs, so make sure you factor in those additional costs.

What to consider before applying for cash-out refinancing

Applying for any type of loan or refinancing is a big decision. When you’re making major financial decisions, it’s important to consider your current financial situation and long-term goals before taking action.

Current market conditions can have a significant impact on cash-out refinancing. Cash-out refinance rates change as market conditions change, and the value of your home can also increase or decrease depending on the housing market. Consider consulting an expert to figure out how current market conditions are affecting cash-out refinances.

Your financial goals are another important factor to consider. What are your long-term financial goals? How are you planning on using the money from your cash-out refinance? Consolidating debt may be a smart move, but you might want to reconsider if you’re thinking about refinancing with a cash-out to fund a major purchase.

Last but not least, consider your future housing plans. Since cash-out refinancing can extend your loan term, you want to ensure you’re comfortable staying in your home for a while. If you want to purchase a new home or relocate to another state, a cash-out refinance probably isn’t right for you.

Ultimately, it’s up to you to determine whether cash-out mortgage refinancing is right for you.

Cash-Out Refinancing: FAQs

What is the maximum amount I can borrow?

When you apply for a cash-out refinancing home loan, lenders determine your maximum loan amount based on your home equity and loan-to-value ratio. This means that the maximum amount you can borrow will vary depending on your situation. You can talk to a lender or apply for a loan to determine how much you can borrow.

How long does the cash-out refinancing process take?

While cash-out refinancing isn’t quite as quick as some loan programs, it doesn’t take long to get approved for a loan and get access to your money. Generally speaking, you can expect the entire process to take between 30 and 60 days. You may receive your check the same day you close your loan, but it can take up to a few business days.

Will I need to pay taxes on the cash I receive?

Even though you typically have to pay taxes on lump sums of cash you receive, that’s not the case with a cash-out refinance. Since cash-out refinances are considered loans, they’re not taxable. That means you don’t have to worry about setting any money aside, so you’re free to spend the funds you receive however you want to spend them.

What’s the difference between home equity loans and cash-out refinancing?

A home equity loan is a second mortgage, which means it creates an additional loan on top of your mortgage loan. When you take out a home equity loan, you must make monthly payments on that loan and your mortgage. With cash-out refinancing, your existing mortgage is paid off, so you only have to deal with one loan.

Is cash-out refinancing right for you?

Whether you want to consolidate existing debt or get access to emergency funds, cash-out refinancing can help. Before you apply for a cash-out refinance, make sure it’s the right decision based on your financial situation.

At Source Capital, we make it easy to qualify for cash-out refinancing so you can get the money you need to take control of your finances. We’ve simplified the cash-out refinancing process with no prepayment penalties and competitive interest rates. With same-day approvals, you don’t have to wait weeks to see if your application is approved.

Are you thinking about using cash-out refinancing to leverage your home equity? Source Capital can help. Apply now or contact us to learn more about cash-out refinancing and how it works.