Google 5-Star Rated Direct Hard Money Lender

What is Hard Money? The Ultimate Guide

Definition of Hard Money

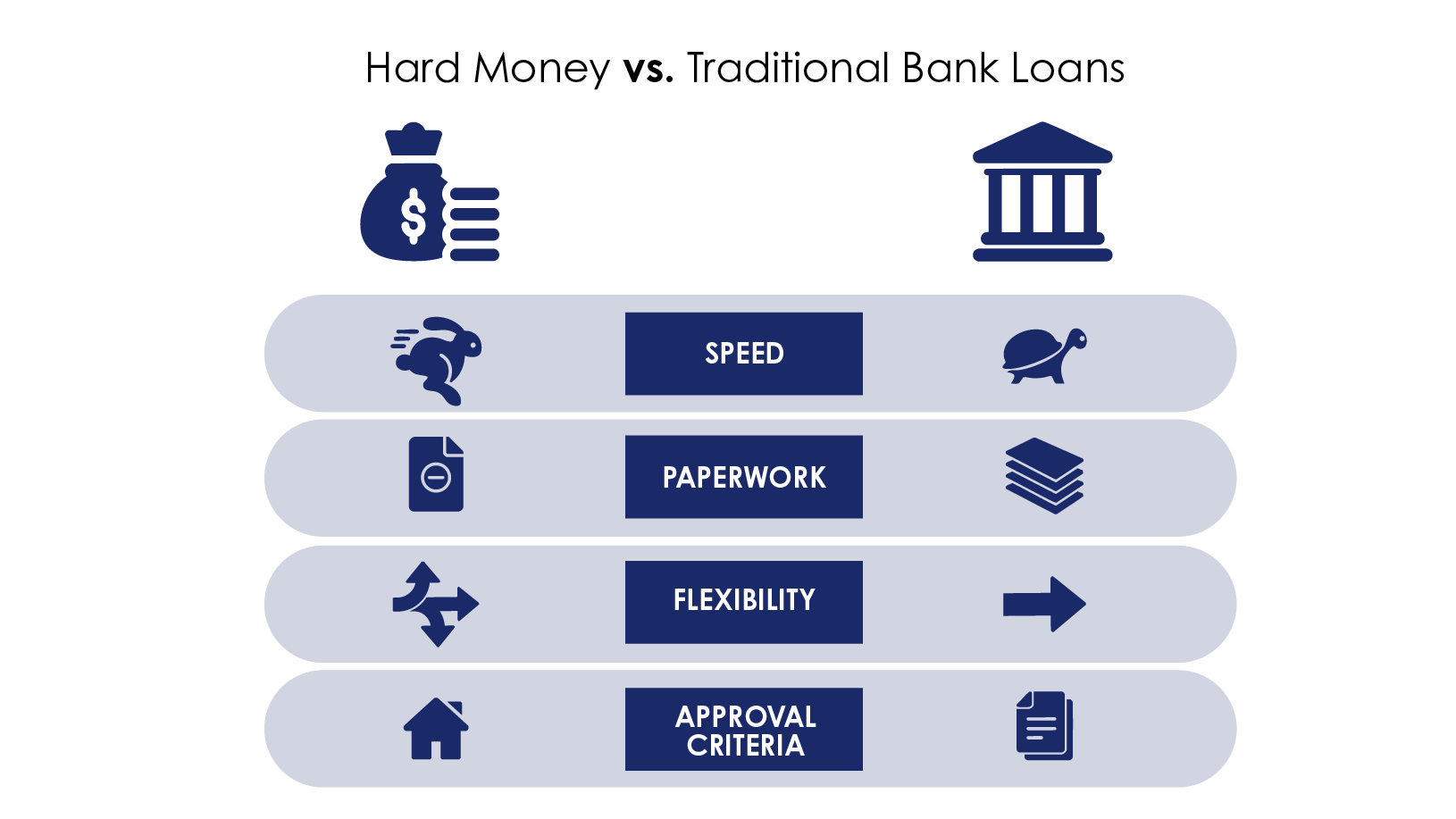

Hard money, sometimes also referred to as “private money”, is the term used for loans secured by real estate that are funded by private parties and are typically offered at higher interest rates than an FDIC insured bank. Hard money underwriting guidelines are almost always less invasive and time consuming than the guidelines followed by a traditional bank or financial institution.

Borrowers seek hard money loans when they are unable or do not have the luxury of time to wait for financing from more conventional sources. This can be due to a number of reasons, which are discussed in the next section.

Why Borrowers Choose Hard Money Loans

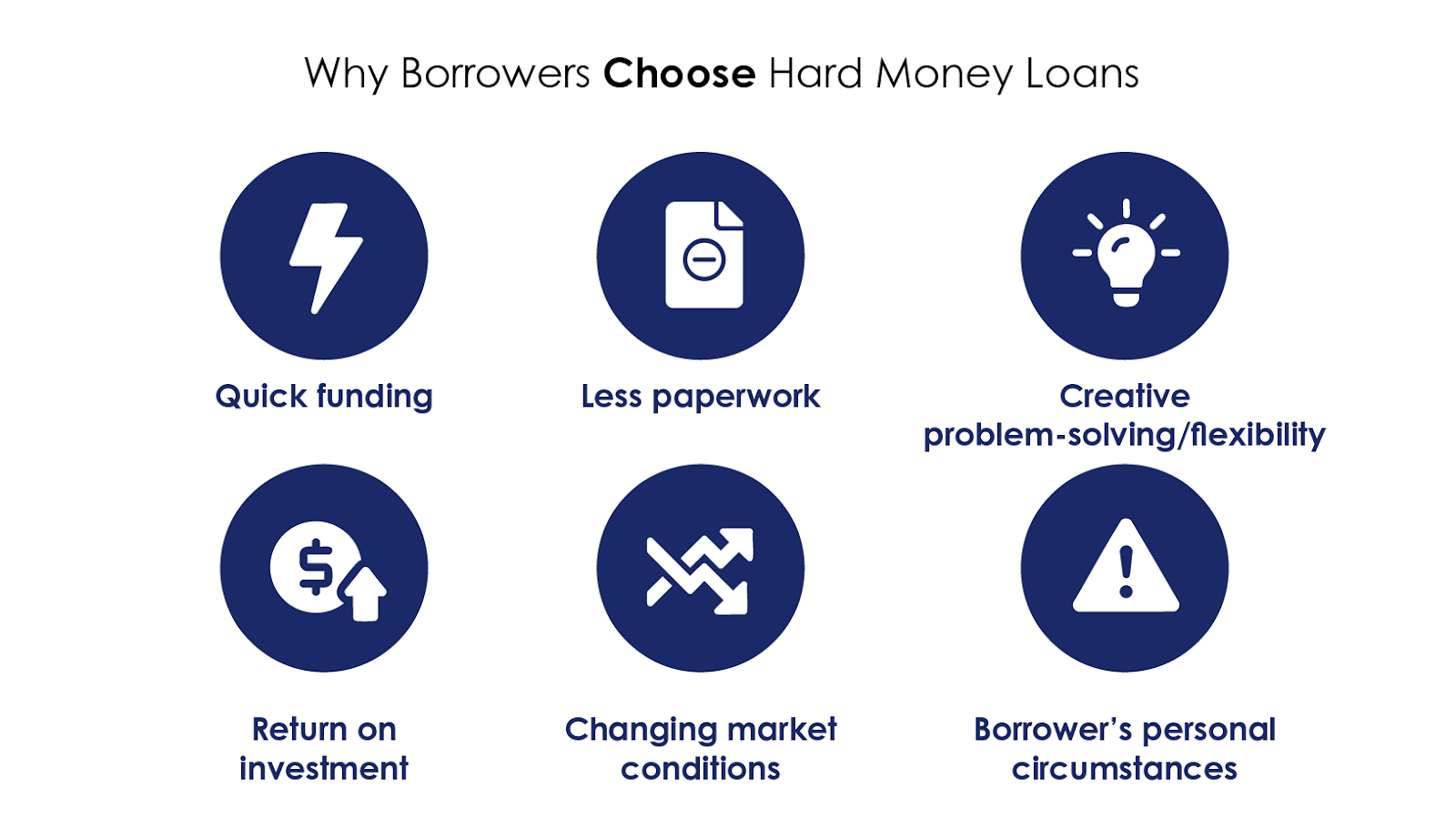

The question often arises as to why borrowers would seek a private money loan for real estate at the high interest rates that private money demands. The immediate assumption is that these are high-risk ventures and the borrowers do not have the credit-worthiness that would allow them to borrow from traditional and conventional sources. There are in fact a wide variety of factors that determine whether or not a borrower would be a candidate for a private money loan. Let’s look at several more common reasons below:

✓ Quick Funding of a Time Sensitive Loan

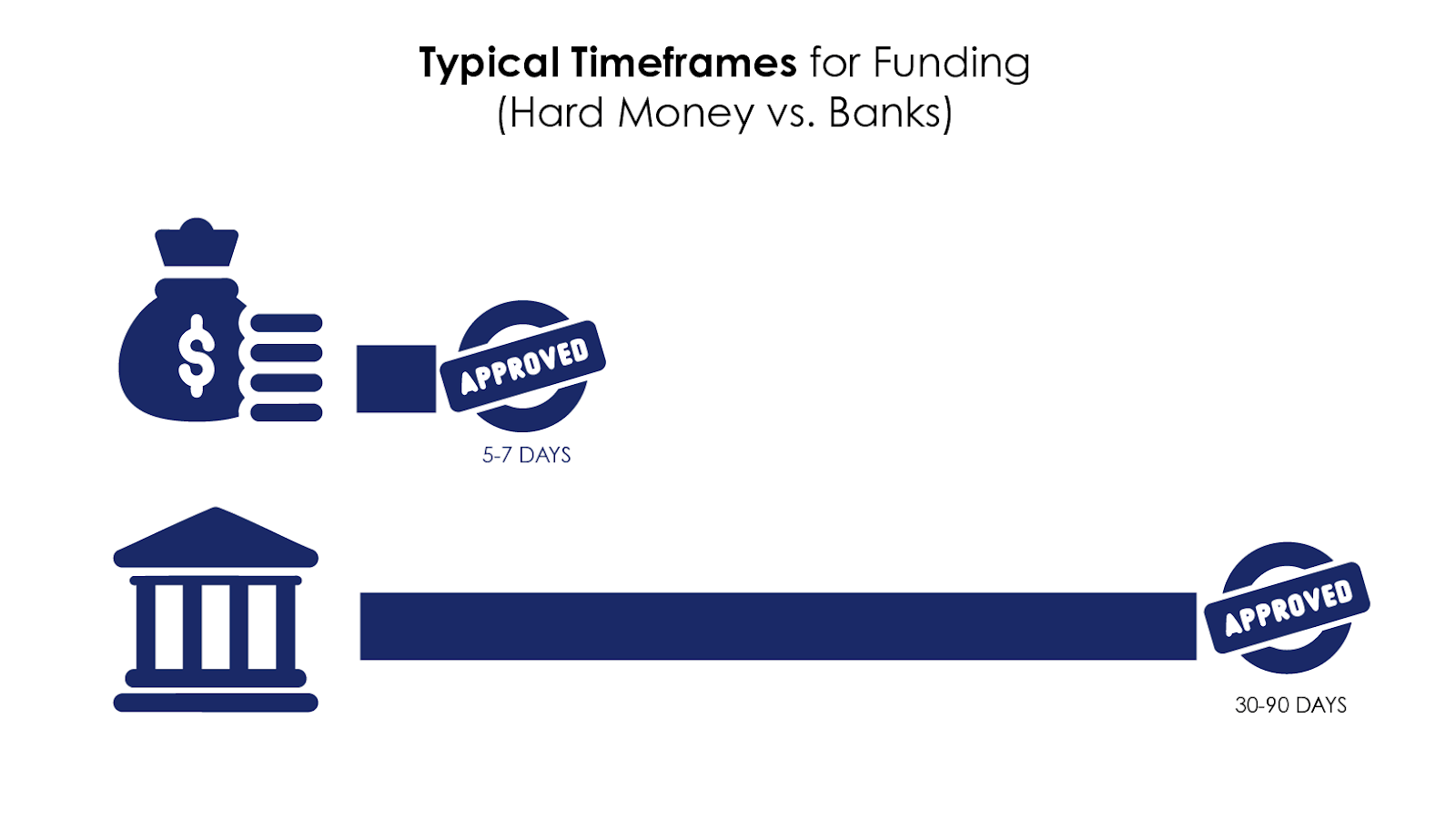

Banks and conventional financial institutions frequently take 90 days or more to close a loan due to strict regulatory requirements and a tedious due diligence process that must be adhered to. A hard money lender can often fund a loan within a week.

✓ Reduction of Red Tape and Paperwork Hassles

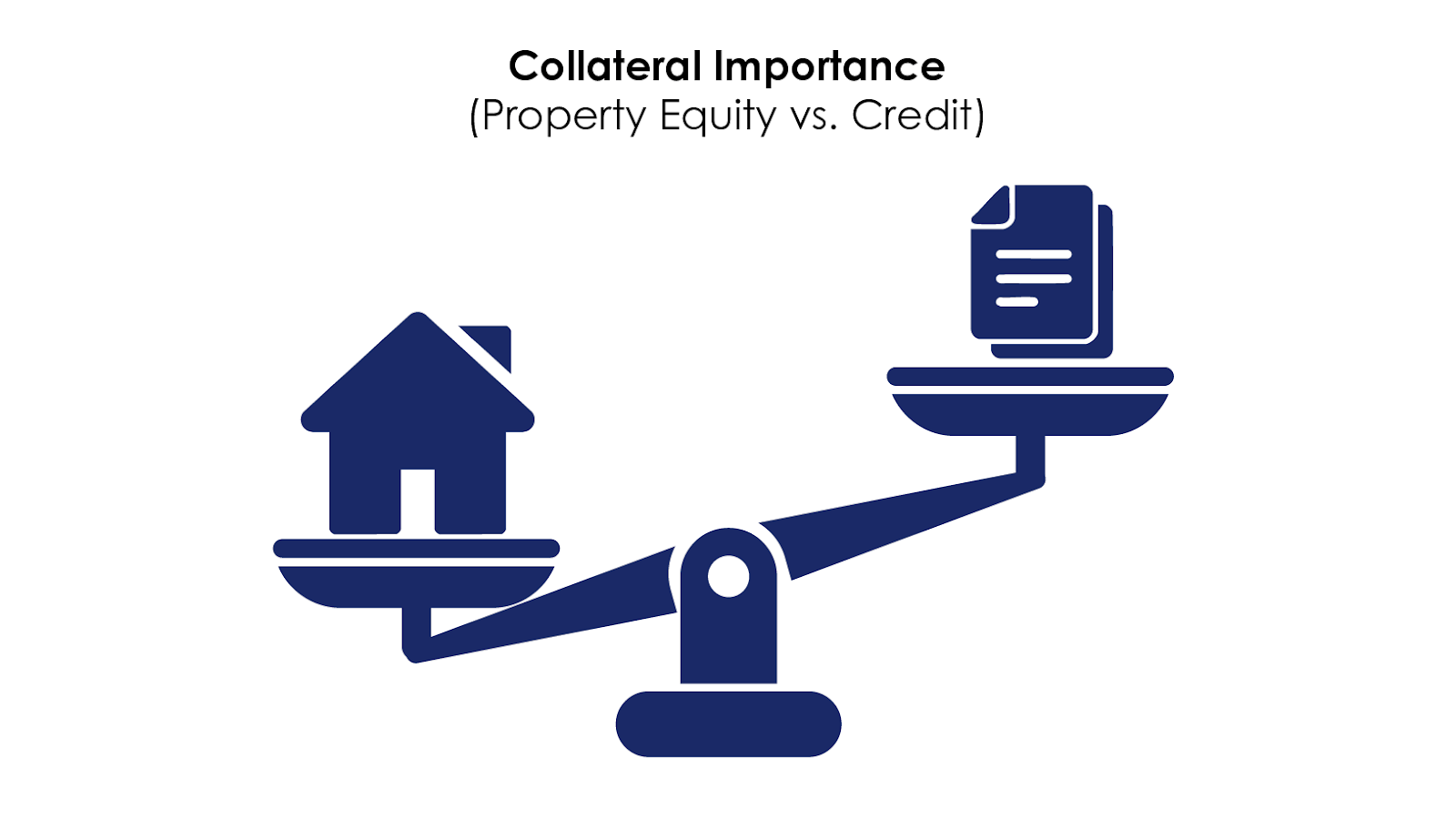

Traditional lenders require substantially more documentation than private money lenders and have more stringent loan committee processes and guidelines. Borrowers must often submit confidential financial information and complete an abundance of paperwork to find out if a loan will be approved. A hard money lender focuses mainly on one aspect of the loan (collateral) while a bank will scrutinize the credit, financials, job, etc. of a borrower.

✓ Flexibility and Creative Problem Solving

Private money lenders are more creative with complex loan situations. They can offer options like cross-collateralization of other properties, or offer more flexible terms than traditional lenders. The property may also have issues that make it difficult for conventional lenders to finance such as the need for improvements to increase the occupancy of a building, or partially completed construction, etc.

Additionally, traditional lenders will not lend on raw land due to their strict underwriting guidelines and are known for limiting the amount of investment properties a borrower can have in their portfolio.

✓ Return on Investment

Many borrowers such as builders, rental property investors and property “flippers” have a specific goal in mind when looking for a loan- speed at which they can get their loan funded. These individuals are focused on making a profit and the simplicity and minimal time it takes with a private money lender can far outweigh the higher cost involved for financing. Time is money.

✓ Nature of the Loan and Market Conditions

The constant change in market conditions and laws that govern the real estate market force conventional financial institutions into taking even more time and have become even more conservative with approving loans. Private money lenders on the other hand have the ability to assess the property or project’s risk and charge an appropriate fee for the perceived risk.

In essence, private money lenders are equity based and the most important component of the loan funding is the evaluation of the real estate. A borrower’s past history and level of commitment plays a part in determining the viability of the loan but is not as paramount to the decision making process.

✓ Borrower Circumstances

Again, these are not just limited to credit problems or a past or current bankruptcy as is most often assumed. There may be tax liens or other liens that need to be paid, or the property may be entering into foreclosure for a variety of reasons. The property may be held up in probate, or involved in a divorce or other family situation. There may be unemployment or a medical emergency.

The list is endless but the principle is basically the same; private money lenders lend on the value of the asset first, and the strength of the borrower second. Ultimately, the decision resides with an experienced underwriter to evaluate the “whole story” when evaluating a potential borrower. Private money is used by a wide variety of borrowers ranging from very high net worth individuals to sophisticated real estate investors and developers, all of whom prefer the speed and simplicity of the loan process.

There are numerous reasons why a borrower would seek a hard money loan. More often than not, it is due to not being able to qualify at a bank because of strict underwriting guidelines.

The Loan Process

Requirements

Depending on the type of lender, the due diligence items required from the borrower can vary greatly. For instance, it is well known that banks or other conventional lenders can require documentation that most of the general public feel is “overkill” and tedious. In addition, traditional lending sources quite often require documents, or updates, all the way up to the actual closing of the loan.

On the other hand, a hard money lender is well- known for requiring much less documentation and will often only need the information to be provided at one time. Whereas a bank is looking closely at the borrower (credit, financials, etc.) and property being pledged as collateral for a loan, a hard money lender is placing the greatest emphasis on the equity in the property.

Timeframes

Hard money lenders, because of their documentation requirements and quick underwriting process, can often fund loans in as little as 5-7 business days. In some instances, a hard money lender can even fund in a matter of hours.

As mentioned earlier, with the myriad of requirements to qualify for a traditional bank loan and the fact that there are a number of individuals involved in the loan approval process, the typical time to fund can be anywhere from 30-90 days.

The main difference between a hard money lender and a bank is based on the speed, flexibility and documentation required with the underwriting and funding of a loan.

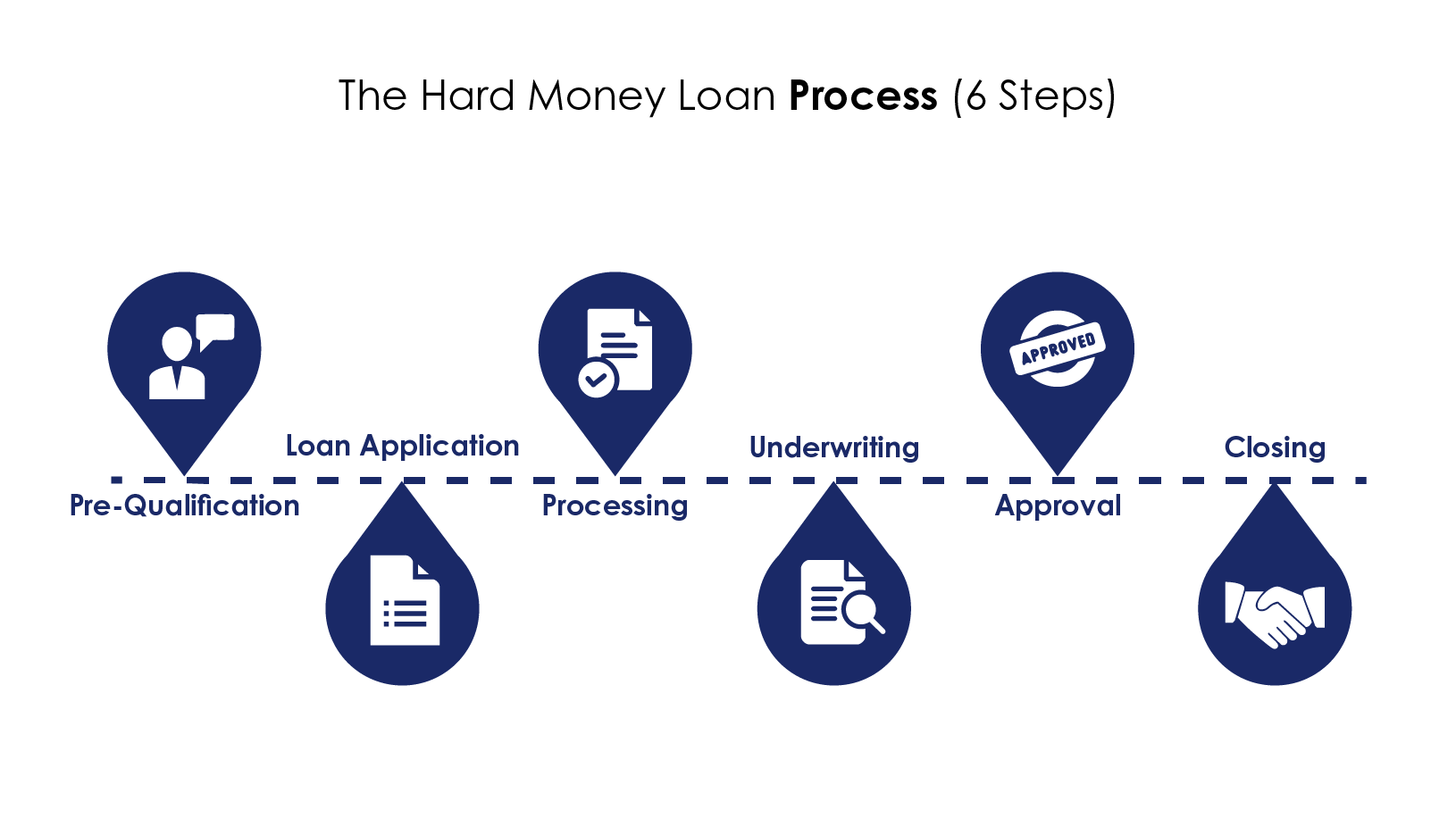

Steps

The steps involved in the loan process vary greatly between a hard money lender and a bank. Following is a list of the six primary steps taken by a hard money lender as it pertains to a residential (1-4 units) loan. As it pertains to Source Capital Funding, Inc., we can provide an approval within 24 hours and funding in a matter of days.

In addition, we will highlight the differences in this process as compared to a bank. The six steps include Pre-Qualification, Loan Application, Processing, Underwriting, Approval and Closing.

1) Pre-Qualification

This occurs before the loan process actually begins, and is usually the first step after initial contact is made. In a prequalification, the lender gathers information about the borrower and property being used as collateral for the loan. The property itself is typically the single most important factor when determining whether or not to move forward in the loan process. Other factors, to a lesser degree, include borrower credit and financial stability.

2) Loan Application

The “application” is actually the beginning of the loan process and usually occurs the same day or following day after the Pre-Qualification. The borrower completes a loan application, authorization for lender to check credit, letter of explanation and proof of income and employment and submits to lender for Processing.

At this time, all parties should be clear as to what the loan request is and a solid understanding of what the borrower’s situation is and how the lender can help. It is important to note that the lender is required to submit a Good Faith Estimate (GFE) and a Truth-In-Lending Statement (TIL) to the borrower within three days of receipt of a completed loan application. These documents help the borrower understand all costs associated with the loan and terms.

3) Processing

Once the loan application is completed, it is assigned to a loan processor. It is during this process that a credit report is ordered and an appraisal obtained on the subject property being used as collateral for the loan. The loan processor’s main duty is to ensure all the documents submitted by the borrower are complete and accurate.

This includes verifying the borrower employment status (W-2s and pay stubs), assets (checking, savings, 401K, etc. accounts), and outstanding debts (credit cards, auto payments, student loans, etc.). At this time, if there are any issues or questions regarding the information provided, the processor will ask the borrower for additional clarification and documentation. Once the processor has an entire package completed, he/she will submit to the underwriter to initialize the underwriting process.

4) Underwriting

An underwriter’s main task is to assess the risk in a loan. In the mortgage underwriting process, an underwriter reviews or “underwrites” all aspects of the loan from the borrower’s finances, employment and credit to the real estate being used as collateral. In short, the underwriter is responsible for determining whether the package submitted by the processor is deemed as an acceptable loan for the lender’s portfolio.

Underwriters typically look for the following “3 Cs” to Underwriting:

- Collateral – What is the value and type of property being pledged as collateral?

- Capacity – Does the borrower have the resources and means to debt service the loan and payoff at term?

- Credit – Are there any issues with the borrower’s credit history?

For a hard money underwriter, the focus is predominantly based on the collateral, as it is the single, most important item that secures the loan. The ability to repay (capacity) and the credit history (credit) of a borrower are important but is not what provides the lender the most security; the equity in the property is paramount. Unfortunately for a borrower, jobs, financial situation, life events (marriage, divorce, birth, death, etc.) can change in a manner of minutes and all these factors can have a significant impact on the loan.

Historically, real estate values do not have the instant volatility as a borrower would and thus, the values are weighted more heavily than a borrower’s income, job, etc. In summation, an underwriter wants to make sure a loan amount does not exceed a property’s value. Otherwise, a lender may not be able to recover a loan’s unpaid balance, in the case of default.

The equity in the property being used as collateral for a loan is the most important factor to a hard money lender.

5) Approval

If approved, the lender will send the borrower a commitment letter. This letter outlines all terms and conditions for the loan and the borrower will be given a set amount of time to accept the offer. If the terms are agreed upon by the borrower, the lender may ask for a few additional items from the borrower including, but not limited to, proof of hazard insurance, any HOA information, payoff demands from other creditors, property tax information and title and escrow contacts (if not opened already).

6) Closing

The closing process involves three parties – the borrower, lender and escrow agent. Each party has a specific role. For the borrower, closing is synonymous with signing loan documents. During this time, the borrower will have to review, sign and date numerous legal documents. While this process may seem tedious and redundant, it is necessary to protect all parties.

The lender is responsible for sending all loan documents to the escrow agent to arrange for the borrower to sign and for wiring the loan proceeds to the escrow agent for delivery to the borrower.

Keep in mind that the lender has worked directly with the borrower throughout the loan process and is intimate with all details regarding the loan so the loan documents are typically error free, thus saving valuable time. The escrow agent is responsible for ensuring the borrower properly executes all the necessary loan documents required by law as well as working with a title agent to secure a title insurance policy.

Once the loan documents have been signed by the borrower, the escrow agent sends the original documents to the lender (except for the Deed of Trust) and the lender wires funds to the escrow agent. The most important step in this process is for the escrow agent to record the Deed of Trust (mortgage) with the County Recorder in which the property is located. The recordation if this document provides public notice that there is a lien (loan) on the property. Once the Deed is recorded, the funds are released to the borrower and the loan is closed.

At closing there are typically three parties (borrower, lender and escrow agent) and each has a specific role that they must fulfill.

Advantages of Using Source Capital Funding, Inc.

There are a myriad of private lenders, individuals and entities that provide loans secured by real estate. Like any business, some are good and some are not; but how do you know? What separates a good lender from the rest? Cost is always a concern for a borrower and the interest rate and fee charged is a significant factor.

However, it is imperative for one to consider that the lender, once the loan is funded, will place a lien on your property and will be “tied” to a borrower throughout the term of the loan. It is of utmost importance for a borrower to know what they are getting into and with whom.

As a state and federally licensed direct lender, Source Capital Funding, Inc. provides:

- Experience – Since 2006, Source Capital Funding, Inc. has underwritten over $1.4B in loans secured by real estate. From residential and commercial properties to lot and land financing, the firm has the underwriting knowledge and funding capabilities to close loans.

- Integrity – Integrity is a unique blend of proven honesty and ethical business principles that are earned over time. As a Better Business Bureau member since 2007, the company has earned the prestigious “A+ Rating” for its sound business practices. Reputation – From borrowers to brokers and investors, Source Capital has received numerous testimonials through mail, email and Internet reviews. We are proud of our impeccable reputation with our clients and know that the relationships built will last a lifetime.

- Transparency – We believe in full disclosure and educating our clients. Source Capital ensures that the expectations of its clients are met by communicating all details of the loan process, no matter how small, in order to ensure clarity. The firm provides all important details in writing from start to finish to ensure clarity and save valuable time.

- Customer Service – From the infancy stages of an initial call with a client until the loan is funded, Source Capital is intimately involved in the process. It is important that clients understand that we are here to help and are available any day during the week to accomplish this.

- Fair Terms – Source Capital believes in offering its clients an interest rate and loan they can afford while allowing for the ability to pay back a loan at any time. We have no prepayment penalties or “junk fees” associated with our loans and offer market rate interest rates