Google 5-Star Rated Direct Hard Money Lender

What Is a Home Appraisal?

A home appraisal is a valuation of a home that’s used when buying or selling real estate. Home appraisals are based on the size and condition of your home as well as recent sales of comparable homes in your area. At Source Capital, we offer a wide range of loan options to help you get the money you need to invest in property.

Getting a home appraisal is an essential first step if you plan on buying or selling a home. Whether you’re buying or selling, mortgage lenders require a home appraisal to determine interest rates, down payments, and other key loan terms.

If you’re planning on buying or selling a home, you might have a few questions. What is a home appraisal? How much does a home appraisal cost? What happens if an appraisal is lower than expected?

In this guide, we’ll walk you through everything you need to know before getting an appraisal to buy or sell a home.

- Understanding Home Appraisals

- Why Are Home Appraisals Important?

- How Does the Home Appraisal Process Work?

- Factors That Affect a Home’s Appraised Value

- Common Home Appraisal Outcomes

- How to Prepare for a Home Appraisal

- Home Appraisal: FAQs

- Considering a Hard Money Loan?

Understanding Home Appraisals

A home appraisal is a home valuation based on the property’s size and condition, the size of the lot, and any upgrades or additions made to the property. Appraisers also look at “comps,” which are comparable homes in the same area as your home. Looking at recently sold homes in the area can help appraisers determine an accurate value.

Why Are Home Appraisals Important?

While getting a home appraisal is a requirement if you’re working with a mortgage lender, it’s recommended for any real estate transaction. Here are some of the benefits and reasons why a home appraisal is important:

- Appraisals ensure the buyer isn’t overpaying for a property

- The lender is protected since the value of the property is verified

- Sellers can set an accurate and competitive price

- Appraisals help with property tax assessments

How Does the Home Appraisal Process Work?

If you’re researching loan programs and planning on buying your first home, you might feel a little overwhelmed. Fortunately, home appraisals are simple and easy. Let’s take a look at how the home appraisal process works.

1. Scheduling the Appraisal

Scheduling your home appraisal is the first step — and it’s a step you don’t have to worry about. When you apply for a mortgage or DSCR loan, your lender will hire an independent appraiser who will schedule an appraisal for your home.

2. On-Site Inspection

The next step is an on-site inspection. During this inspection, the appraiser will look at the size of the property to make sure it’s listed accurately. Your appraiser will also look at the condition of the home as well as any upgrades or features that were added to the home.

3. Comparable Sales Analysis

Once the inspection is complete, appraisers look at “comp” homes to help determine the value of your home. Comp homes are homes that are similar to yours in size, condition, and location that were recently sold.

4. Final Report

Finally, all that information is used to create an appraisal report. This report includes the property value, the effective date, relevant property details, and anything the lender requests on the report. If the buyer is taking out a mortgage loan, their lender will use this appraisal to verify the property value. You can also use this final report to make sure your home is competitively priced.

Benefits of Getting a Collateral Loan

Factors That Affect a Home’s Appraised Value

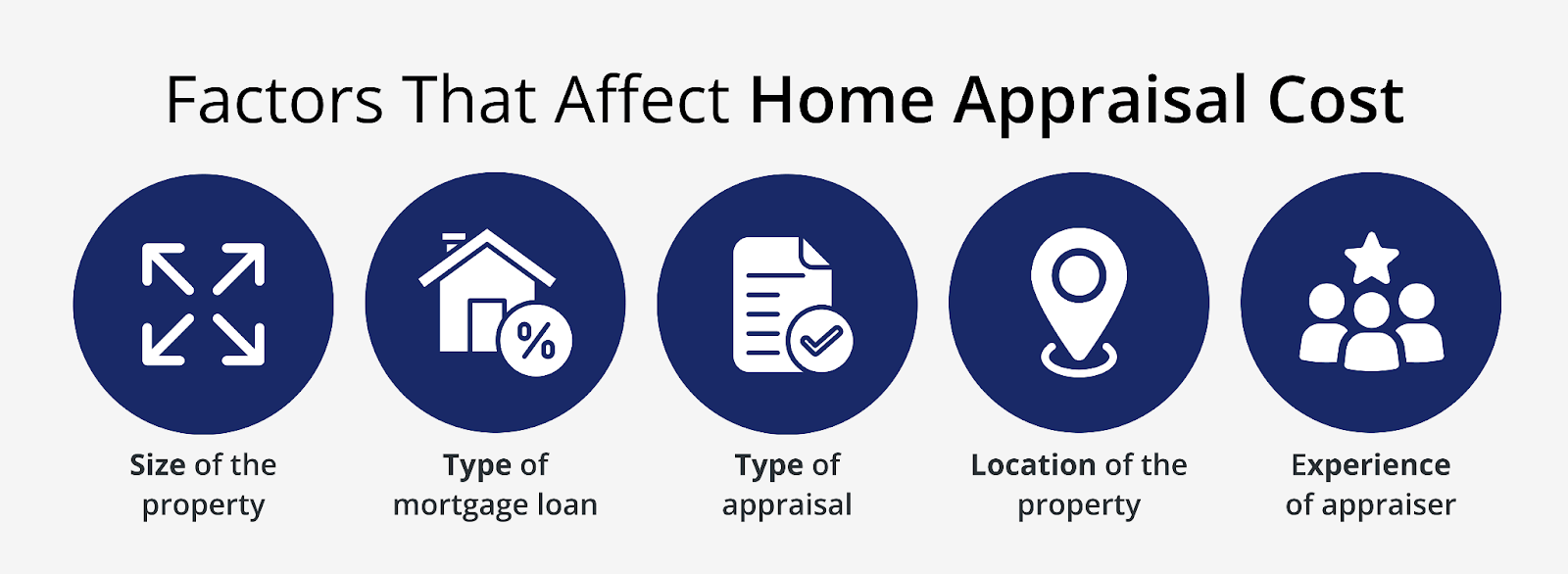

Whether you’re taking out fix and flip loans, traditional mortgage loans, or trying to sell your home, it’s important to understand what affects the appraisal value of your home. Here are some of the key factors:

- Location and neighborhood quality: Whether you’re near the beach or in a beautiful private neighborhood, location plays a big role in the cost of a house. Buyers also look at crime rates, schools, and other factors that change from neighborhood to neighborhood.

- Property size and condition: Larger properties are more expensive, but condition is important, too. Homes that need extensive repairs will generally have a lower appraisal value.

- Recent upgrades or renovations: If you recently added an accessory dwelling unit (ADU) or renovated your home, that can increase the value of your home.

- Market trends and comparable sales in the area: Appraisers look at similar homes that have recently sold in your area to identify market trends and get an accurate price.

- External factors like proximity to amenities: If you’re far away from grocery stores, restaurants, and other amenities, your home may not be worth as much as a home that’s near these amenities.

Common Home Appraisal Outcomes

There are essentially three outcomes when you’re getting a home appraised. We’ll talk about each outcome and what it means for you below.

Appraisal Meets the Purchase Price

If the appraisal meets the purchase price, everything is good to go and the sale of the home can proceed. Lenders will use the appraisal report to determine your interest rate and down payment and offer you a loan. Bridge loans and other types of home loans also require appraisals that meet the purchase price.

Appraisal Is Higher Than Purchase Price

In some cases, the appraisal may be higher than the purchase price of a home. If that’s the case, you benefit as the buyer because the home you’re buying is worth more than you purchased it for.

Appraisal Is Lower Than Purchase Price

When the appraisal is lower than the purchase price, your lender may offer you a loan based on the loan-to-value (LTV) ratio in your contract. Your lender won’t lend you more than the appraised value, which means you need to find a way to make up the difference between the appraisal and purchase price. Alternatively, you can negotiate with the seller to get a lower price.

How to Prepare for a Home Appraisal

Whether you’re buying or selling a home, being prepared can help you get the most out of the appraisal process. Let’s take a look at what you need to do to prepare for an upcoming home appraisal.

If you’re a seller, you can start by cleaning up your home to make sure there’s nothing that’s going to lower the appraisal value. Next, perform a thorough inspection to look for any minor damage around your house. If you notice anything you can easily fix — like damaged paint — you can fix that before getting your home appraised. You can also mow your lawn and trim shrubs below window level to maximize the curb appeal of your home. The last thing you want to do is provide a list of upgrades you’ve made to your home.

When preparing for a home appraisal as a buyer, most of the work that needs to be done is the responsibility of the lender and seller. As a buyer, the best thing you can do is learn about the home appraisal process and set realistic expectations. Understand that there’s a chance that the appraisal value won’t meet the purchase price, and make sure you have a plan in place in the event the appraisal is lower than the purchase price.

The home appraisal process is usually fairly quick and painless, so don’t be intimidated going in.

Home Appraisal: FAQs

How long does a home appraisal take?

Appraising a home may seem like a long and complex process, but it’s a lot simpler than it seems. Since appraisers need to look at comp homes and inspect a home before appraising it, you can expect to wait a week or two before you get a full report from your appraiser. Keep in mind that this is an estimate; in some cases, your appraisal may be delayed for some reason and it could take up to a month.

Can I choose my own appraiser?

The premise of a home appraisal is to get an accurate, unbiased valuation of your home. Whether you’re a buyer or a seller, you typically can’t hire a home appraiser because you could influence them to give you a more favorable appraisal. Home appraisers are typically hired by your lender as an independent third party. That way, you get an accurate appraisal that’s fair to both parties.

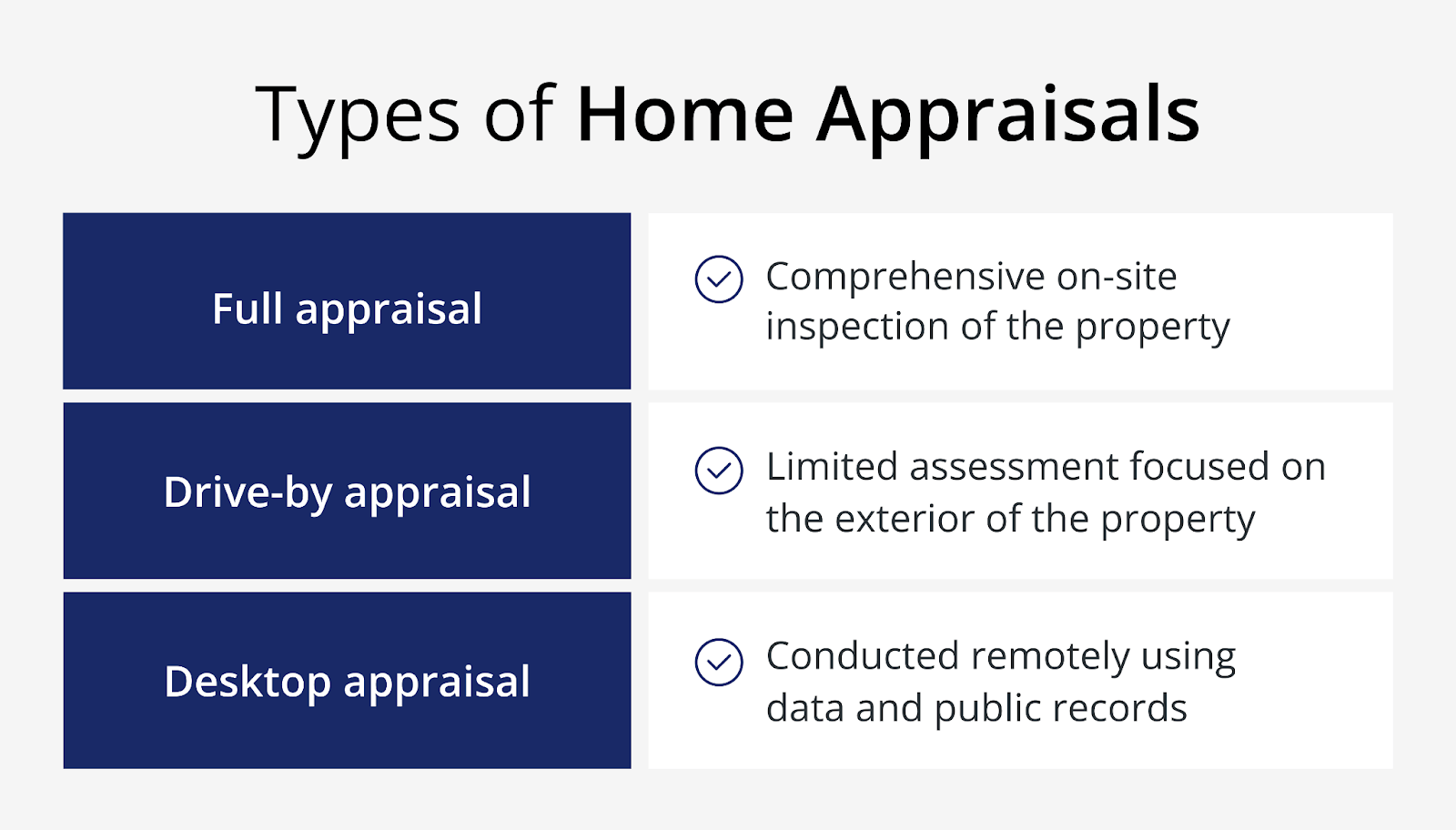

How much does a home appraisal cost?

Home appraisal costs can vary based on where you live and what type of home you’re having appraised. According to Zillow, the average cost of a home appraisal is about $500-$800. Some states are significantly more expensive than others, including New Mexico, Oregon, and Washington. Appraisals may also cost more if you’re applying for a government-backed loan like a VA or USDA loan.

Considering a Hard Money Loan?

Investing in real estate can be lucrative, and hard money loans can help. At Source Capital, we offer hard money loans for rental properties so you can start investing in real estate. With same-day approvals, NO APPRAISAL FEES, and rates starting at 8.99%, we can help you secure the funds you need to purchase rental properties.

We can even work with you if you have poor credit or a high debt-to-income (DTI) ratio. If you have questions, our experts are here to help. If you’re ready to find out more and see if you qualify for a hard money loan, apply now.