Google 5-Star Rated Direct Hard Money Lender

Transform Your Properties with Hard Money Rehab Loans

Ever wanted to turn a dilapidated property into cash? You can, with a hard money rehab loan. These loans provide the funding rehabbers need to purchase, renovate, and sell properties for a profit. With flexible terms, short timelines, and high loan amounts, they can help a range of property investors achieve their financial dreams.

Want to learn more about hard money rehab loans? Read on to learn all about this loan type, its benefits, and how to secure your own.

What Are Hard Money Rehab Loans?

Hard money rehab loans are short-term, asset-based financing tailored to property renovation and flipping projects. Unlike traditional financing loans, which are secured using creditworthiness, these loans are secured using property as collateral. These loans are secured by private funding for a flexible alternative to bank loans.

Hard money loans are a favorable solution for those who need quick access to short-term financing. Their terms include:

- Short duration: Typically 12-24 months

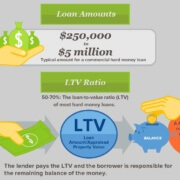

- High loan amounts: Ranging from $100,000 to $5M

- Fast financing: Funded in as little as 10 days

- Higher interest rates: Ranging between 8% and 14%, depending on risk and loan position

Key Features of Private Lending

Hard money rehab loans offer key features like:

- Rapid approval processes: Don’t miss a great investment opportunity because your funding takes too long.

- Minimal financial documentation: Hard money loans are forgiving for those who have alternative income streams, poor credit, or a history of bankruptcy.

- Structured draw schedules: Receive more funding as you reach project milestones.

How Hard Money Differs from Traditional Real Estate Financing

Compared to traditional real estate financing, hard money rehab loans offer:

- Fast underwriting: Without the need for income verification and credit checks, hard money loans can be financed much more quickly

- Lower LTVs: Hard money loans typically offer between 65% and 70% LTV

- Greater tolerance for distressed properties: These loan types are often used to purchase and rehab properties in disrepair

- Flexible loan structures: Don’t be held back by rigid bank guidelines

The Role of Hard Money Loans in Property Flips and Rehabs

For property rehabbers, hard money loans serve as the financial bridge between a property acquisition and long-term financing or sale. They help secure deals and fund renovations before conventional mortgages even become available.

Bridge Financing for Speedy Acquisitions

In a competitive market, rehabbers need near-instant access to funding, sometimes in as little as a few days. Access to pre-approved hard money can give you the leg up you need to beat out traditional buyers in foreclosure auctions or when the market is moving fast.

Short-Term Loans vs. Conventional Mortgages

Hard money rehab loans offer terms between 12 and 24 months, many times shorter than traditional bank loans. While they often come with higher interest rates, their shorter terms often mean you’ll pay less interest by the time your loan reaches maturity.

Another important facet of hard money rehab loans that isn’t present in conventional mortgages is an exit strategy. Most hard money loans are structured with interest-only payments throughout the duration of the loan and a balloon payment at the end. Lenders need to have a clear plan to pay off that balloon payment when the time comes.

Benefits of Hard Money Rehab Loans for Investors

For investors looking to purchase, rehabilitate, and sell a dilapidated property, hard money rehab loans may be just the answer. Read on to learn about the benefits of these loans for investors.

Accelerated Project Funding & Draw Disbursement Schedules

Hard money rehab loans provide very fast funding, in a matter of days rather than months. In many cases, they’re set up with draw schedules that are tied to completed rehab stages, like foundation, framing, and interior finish. Many rehabbers find this keeps projects on track. This type of draw schedule also minimizes interest and aligns payout with contractor progress.

Flexible Borrowing Options with Bridge Financing

Hard money rehab loans come with much more flexible borrowing options. Borrowers can choose from:

- Interest-only draw loans: Funding is tied to project milestones. Interest-only loan payments throughout the duration of the loan with a balloon payment at the end.

- Combined purchase-plus-rehab financing: The loan covers the cost of the property purchase with additional funding for the rehabilitation.

In many cases, hard money loans can also be adjusted mid-project if the scope changes. In these cases, you can expect updated cost estimates and adjustments to loan terms.

Simplified Qualification through Streamlined Credit Underwriting

Because hard money rehab lenders are focused on property value and equity, they don’t pay much attention to personal income or credit scores. Borrowers with low credit or even past bankruptcies are encouraged to apply. Less income verification also means less paperwork and fewer regulatory hurdles, resulting in faster approvals.

How to Secure a Hard Money Rehab Loan

Ready to apply for your hard money rehab loan? Here’s what to expect, step-by-step.

Evaluating Hard Money Lenders and Interest Rates

First, take time to compare hard money lenders. Look at factors like LTV, approved property types, typical fees, and interest rates. It’s also important to read term sheets closely for hidden fees like prepayment penalties, late fees, and conditions on funding draws.

Do your due diligence in researching lenders’ reputation, too. Read online reviews or check with the Better Business Bureau to ensure that your hard money lender has a history of successful, positive transactions.

Crafting a Detailed Rehab Budget and Draw Schedule

Next, it’s time to create a plan. Put together a detailed rehab budget but line-items for materials, labor, permits, inspections, contingencies, and possible overages. It can help to break your project into stages, for instance demolition, rough-in, and finishes, and then assign each of those stages a draw request.

Navigating the Application and Underwriting Process

Then, it’s time to apply for your hard money rehab loan. Provide all necessary documentation, including the purchase agreement, title report, a scope of work, contractor bids, and proof of funds for down payment. You can expect your lender to order an appraisal of your property. They’ll use this number alongside their LTV to calculate your loan amount.

Managing Draw Requests, Disbursements & Interest Reserve Accounts

Once you’ve been approved for your loan, you can expect regular site visits for each draw. To avoid out-of-pocket interest payments, keep an interest reserve account to cover monthly interest costs during construction.

Planning Your Exit Strategy: Refinance, Sale or Bridge Out

As rehab draws to an end, it’s time to plan your exit strategy. You may sell your property or refinance into a conventional loan. Be sure to leave yourself plenty of time to enact your exit, otherwise you may be subject to last-minute rushes or costly extensions that can eat into your profit.

Common Mistakes When Using Hard Money Rehab Loans

Don’t make these common mistakes with your hard money rehab loan.

Underestimating Rehab Costs in Your Budget

Carefully evaluate cost when building your rehab budget. Get bids from multiple contractors and build a 10-20% contingency buffer into your budget. Relying on rough estimates can get you into hot water down the line.

Neglecting to Fund an Interest Reserve

Keep a reserve on-hand to pay for interest. If you run out of cash, you risk defaulting on your payments or throwing off your project timeline. In a worst-case scenario, this can lead to foreclosure.

Failing to Build in Contingencies for Overruns

Similarly, it’s essential to build a contingency into your timeline and budget. Here, too, you risk your project coming to a halt and potential foreclosure.

Lacking a Clear Exit Path or Refinance Plan

Every hard money loan needs a defined endgame, whether a sale, refinancing, or even paying off the loan with other cash reserves.

Frequently Asked Questions

What Credit Score Is Needed for Hard Money Rehab Loans?

While credit score requirements can vary depending on your hard money lender, they’re usually quite low. At Source Capital, we have no minimum credit score requirements.

How Long Can I Keep a Hard Money Loan?

Exactly how long you can keep your hard money rehab loan depends on its terms. While a loan can be paid off early, it typically cannot be paid off late.

Can I Refinance a Hard Money Rehab Loan?

Refinancing is a very common exit strategy for hard money rehab loans.

Are There Prepayment Penalties on Hard Money Loans?

It depends on the terms of your hard money rehab loans. It’s vital to carefully read your loan agreement and ask questions like these to ensure you won’t be caught off guard down the road. At Source Capital, we never charge prepayment penalties.

Conclusion: Transform Your Rehab Projects with Hard Money Loans

Hard money rehab loans enable faster acquisitions, full-scope renovations, and unlock higher leverage. Borrowers need to create thorough budgets and solid exit plans to ensure maximum returns. With good project management and flexible private lending, hard money rehab loans can turn undervalued properties into profitable assets.

Interested in a hard money rehab loan? Discover what Source Capital can do for you.