Google 5-Star Rated Direct Hard Money Lender

14 Questions to Ask a Hard Money Lender

When purchasing an investment property, your hard money lender is one of the most important partnerships you’ll establish. The right hard money lender can lead to a successful and profitable exit, whereas the wrong lender can cost you time and money, and potentially result in project failure.

Read on to learn 10 essential questions to ask your hard money lender for the best possible outcome.

Why Asking the Right Questions Matters When Choosing a Hard Money Lender

Terms, fees and policies vary widely from one hard money lender to another. By comparing lenders, you can save time and money. It can also help you uncover hidden costs and reduced risks around timelines, permits, and unexpected expenses. By asking targeting questions, you can find a professional, experienced, and communicative lender.

How Hard Money Loans Operate vs. Conventional Loans, Bridge Financing & Asset-Based Lending

While traditional loans are secured using your creditworthiness and income history, hard money loans are secured by collateral property. They offer short terms, fast financing, and much easier qualification than traditional loan types. For borrowers looking to invest in real estate, hard money loans are a ready solution.

Essential Questions to Ask Hard Money Lenders

Vetting your hard money lender is an essential step to getting the best terms possible. Read on for our comprehensive guide to questions to ask your hard money lender, including those surrounding cost, eligibility, timelines, and exit strategies.

1) What Are Your Hard Money Loan Rates, Annual Percentage Rate (APR) and Origination Fees?

First, ask your hard money lender questions about interest rates and fees. Request both the stated interest rate and the APR, so you can get a clear understanding of the complete picture of borrowing costs. It’s also a good idea to ask whether fees are charged as points or as flat fees. Finally, determine whether interest rates are fixed or variable. If variable, find out how often they can adjust during the loan term.

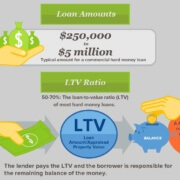

2) What Minimum and Maximum Loan Amounts Do You Offer?

Next, get a better understanding of the loan amount available to you. This is particularly important if you’re looking for a very small or very large loan. You’ll likely find that some lenders set rigid parameters in terms of loan amounts, whereas others underwrite flexibly based on collateral value and borrower history.

3) What Loan-To-Value Ratio (LTV) Can I Expect, and How Is It Calculated?

Minimum and maximum loan amounts give you a clear idea of what’s generally available, whereas the LTV shows what’s available to you. The LTV is a ratio of your loan amount to the total value of a property.

Inquire about how your lender calculates LTV. Some lenders calculate it using the property’s as-is value, while others use the after repair value (ARV).

4) Which Property Types and Projects Do You Fund (Fix-And-Flip, Rehab, Rental)?

Lenders may also vary based on the types of projects they offer loans for. Some focus on quick flips, others may prefer multi-unit rehabs, and some may be equal opportunity. It’s also a good idea to ask your hard money lender questions about any geographic limits, like urban vs. rural, specific states they lend in, and more, as well as property type exclusions they may have.

5) What Loan Term Options, Renewal Policies and Bridge Financing Structures Are Available?

Ask your hard money lender about their available loan term options. They may offer terms like:

- Single-draw rehab loans: A single deposit of all loan funds for rehabs and fix-and-flips

- Multi-draw construction schedules: Funds are dispersed in stages when certain project milestones are reached

- Bridge loans: A single deposit of all loan funds, to be paid back when the collateral property is sold

Then, ask about available loan lengths and whether loans can be extended at the end of their terms.

6) How Is Interest Calculated, and Do You Require Amortization Schedules or a Balloon Payment?

Clarify whether interest accrues on the full loan amount from day one or only on funds as they are dispersed, in the case of multi-draw schedules. Then, find out how payments are structured. They may offer:

- Standard amortization: A percentage of the loan amount plus interest is due with each loan payment.

- Interest-only payments: Only interest accrued on the loan is due throughout the duration of the loan, with a balloon repayment of the principal at the end.

7) Are There Prepayment Penalties or Exit-Strategy Planning Fees?

More vital questions to ask your hard money lender are about fees regarding early payment. If you pay your loan off earlier than planned, will you be charged a penalty?

8) What Escrow and Title Services Do You Use, and What Are the Associated Costs?

Confirm which title company or attorney handles closing and who pays for title insurance. Some lenders require in-house escrow, while others allow borrowers to choose. Ask questions about closing costs, including recording fees, settlement charges, and courier fees.

9) What Borrower Qualification Criteria Do You Require (Credit Score, Experience, Docs)?

It’s a good idea to get a thorough understanding of your lender’s qualification requirements. Some hard money lenders have credit score minimums and require documentation like bank statements and tax returns.

At Source Capital, we’re committed to making loan qualification fast and easy. We have no minimum credit scores and don’t require any financial documentation to approve your hard money loan.

10) How Do You Assess Property Value and Manage the Appraisal Process?

Your hard money lender will conduct their own assessment of your collateral property, so ask questions about how they conduct their assessment. You may find that your lender uses a licensed appraiser, automated valuation models (AVMs) or broker’s price options (BPOs).

Confirm who hires and pays the appraiser and how long the appraiser’s review takes. Ask about secondary inspections or site visits for complex rehab projects.

11) What Is Your Approval Timeline from Application Through Funding?

Ask your hard money lender questions about the average turn-around times and whether funds can close on weekends. Hard money loans from Source Capital are approved within 24 hours and funded within 7-10 days.

12) How Do You Handle Late Payments, Defaults and Due-Diligence Procedures?

Clarify grace periods, daily vs. monthly late-fee calculations, and penalty rate triggers. Ask about options in the event of default, including options surrounding loan restructuring, established foreclosure timelines, and their forced sale process. Make sure you understand the lender’s process for monitoring project progress and compliance with the covenants of the loan.

13) Can You Share Borrower References or Lender Reputation Reviews?

Thoroughly vetting your hard money lender means not only hearing about them in their words, but in others, too. Seek out case studies or testimonials and look for a pattern of on-time closings, fair communication, and smooth payoffs. Check online reviews, Better Business Bureau ratings, and industry forums. You can ask your prospective hard money lender for references, too.

14) How Do You Structure Exit Strategies, and Can I Leverage Multiple Lenders?

Inquire about potential exit strategies:

- Sale: Use the proceeds of the property sale to pay off your loan

-

- Refinancing into permanent financing: Seek a traditional loan, then use the proceeds from that loan to pay off your hard money loan

- Cash reserves: Pay off the loan with existing money

- 1031 exchange: Defer capital gains taxes and reinvest the proceeds into a new property

Ask if blending a second lender for construction or hard costs is allowed, and how that affects senior lien positions. Get information about their policies on simultaneous loans, cross-collateralization or subordinations.

Common Mistakes When Evaluating a Hard Money Lender

Missing small details early in your hard money loan process can cost thousands down the line and derail entire projects. Be sure you don’t make these common mistakes when evaluating your hard money lender.

Overlooking the Full Cost of Fees, APR and Origination Charges

Your hard money lender’s advertised rates can obscure high upfront fees or compounding interest. It’s important to combine all costs, including fees and origination charges, into a ballpark APR to get a true picture of cost.

Ignoring Lender Reputation and Skipping Due-Diligence Checks

Choosing a lender with a strong reputation is essential to your success. Working with an unlicensed or inexperienced hard money lender can result in poor communication, project delays, legal battles, or worse. Verify your lender’s claims by checking their credentials, reading online reviews, and contacting references.

Failing to Compare Loan-Term Options and LTV Offers

Get a full picture of loan terms, including LTV, draw schedules, renewal options, and payback schedules. Be sure not to focus too much on one term over the others; each plays an essential role.

Underestimating Project Timeline Risks and Rehab Requirements

Build plenty of buffer time into your project and loan timeline. Construction delays, permit issues, and weather disruptions are common. Without proper planning, they can push your construction timeline past your loan’s maturity, resulting in failure to pay.

Not Clarifying Exit-Strategy Planning Early

Establish at least one exit strategy before you begin the loan process, as well as at least one backup strategy in the event that things don’t go as planned. Start pursuing your exit sooner than you think, too. A last minute exit may trigger prepayment penalties or rushed funding gaps.

Frequently Asked Questions

Can I Negotiate Rates and Origination Fees with a Hard Money Lender?

Yes, you can, and should, negotiate interest rates and origination fees with your hard money lender.

How Does Approval Differ from Traditional Bank or Asset-Based Loans?

The approval process for a hard money loan is much quicker and easier than traditional bank or asset-based loans. Hard money lenders don’t require extensive financial documentation, if any. Closing time can also be as little as 7 days.

What Happens If I Default on a Hard Money Loan?

Defaulting on a hard money loan puts your collateral property at risk of foreclosure. If you can’t come to a compromise with your lender, they can take over ownership of your home.

Do I Need to Be a Seasoned Flipper to Qualify for Hard Money?

Past experience can help you get better terms on your hard money loan, but it isn’t required for approval.

Can I Use Multiple Hard Money Lenders on One Project?

It depends on your lender. Some lenders will allow multiple lenders on a single project, while others prefer to be the only lender.

Conclusion: 14 Questions to Ask a Hard Money Lender

Asking questions throughout the hard money loan process leads to better terms, smoother projects, and stronger returns. Use this list of questions to ask a hard money lender for the best possible outcome.

For a hard money lender you can trust, meet Source Capital. We offer loans secured by real estate with no prepayment penalties, no minimum credit scores, and funding in a matter of days. With 40+ years of combined experience funding hard money loans, we can help you meet your investment goals.