Google 5-Star Rated Direct Hard Money Lender

How Do Private Money Loans Work?

Whether considering a real estate deal or looking to finance a business, traditional bank loans aren’t always the best fit. Private money loans are less conventional but often more flexible than bank loans, making them a great choice for anyone from investors to business owners.

Private money loans are funded by individuals or companies willing to lend money based on the value of the property or asset rather than your credit score or income. These loans can help investors who need quick financing or have a unique financial situation. Keep reading to learn more about how private money loans work.

- What is a Private Money Loan?

- How Does Private Money Lending Work?

- Benefits of Getting a Private Money Loan

- Things to Consider Before Getting a Private Money Loan

- How to Find the Right Private Money Lender

- Private Money Lending: FAQs

- Get Approved for a Private Hard Money Loan

What is a Private Money Loan?

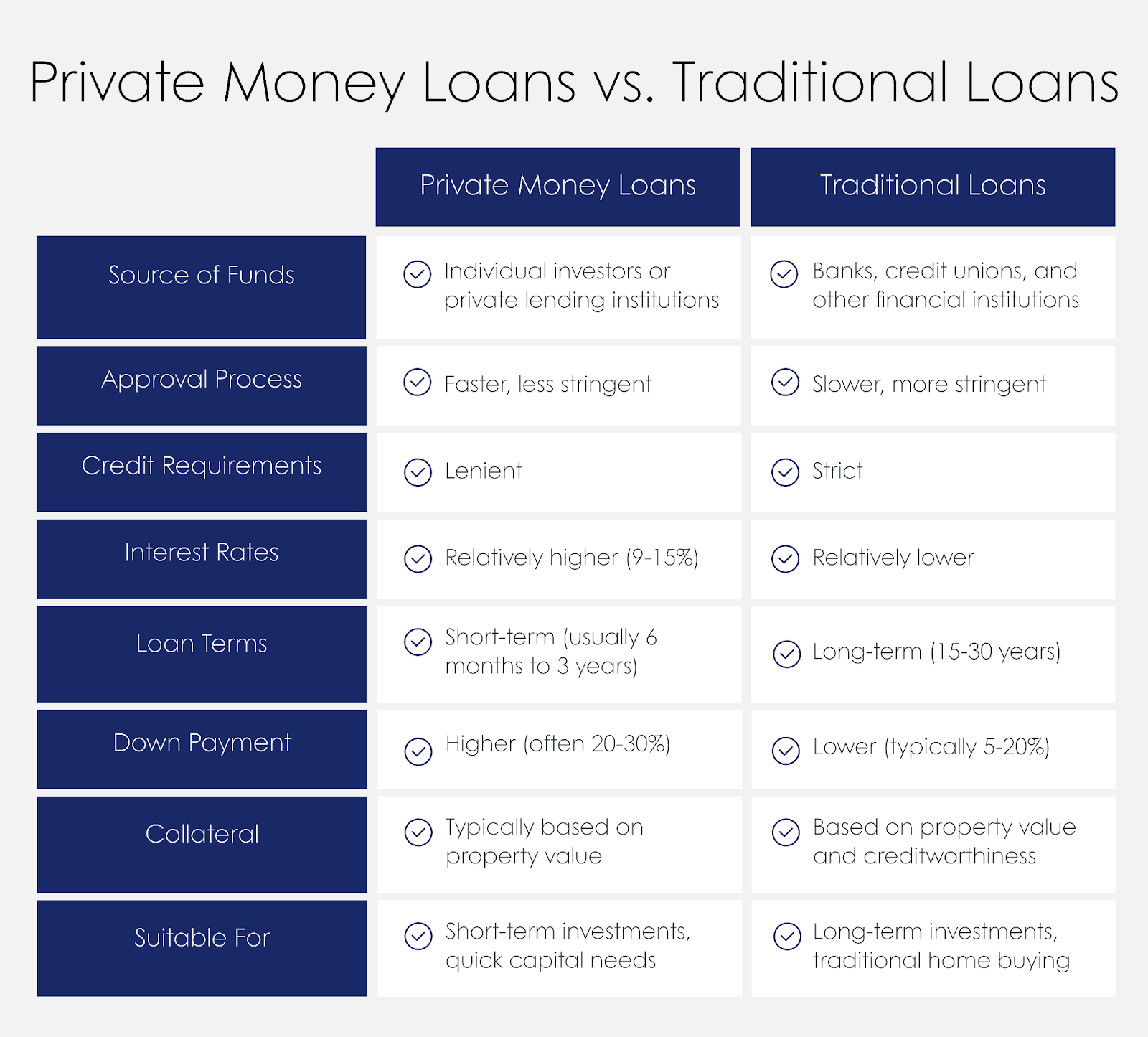

A private money loan is a type of loan program offered by private individuals or organizations instead of traditional financial institutions like banks. These private money lenders could be wealthy individuals, investment groups, or companies specializing in private lending. Unlike traditional loans, which focus heavily on the borrower’s credit score and financial history, loans from private money lenders are typically based on the value of the asset being financed.

These loans are especially popular among real estate investors, house flippers, and borrowers who need to secure funding quickly or have difficulty qualifying for conventional loans. Real estate investors often use private money loans for real estate to purchase properties quickly, renovate them, and then sell them for a profit.

House flippers rely on the speed and flexibility of private money loans to finance their projects, which often need to be completed within a tight timeframe. Additionally, borrowers with less-than-perfect credit or unique financial situations find private money loans to be a valuable alternative to traditional financing.

Hard money loans are a type of private money loan. They’re short-term asset-based loans primarily used in real estate transactions. Like other private money loans, hard money loans are provided by private lenders rather than banks.

How Does Private Money Lending Work?

Private money lending involves borrowing funds from a private lender willing to finance a borrower based on the equity in real estate they already own or want to purchase with a substantial down payment. Unlike traditional bank loans, private money lenders evaluate the asset being used as collateral rather than focusing primarily on your credit score or financial history. This makes private money lending a viable option for borrowers with unique financial situations, past foreclosures or bankruptcies, or those who need quick access to funds.

Despite what you may think, private money lending is still regulated both on the State and Federal level. Lenders must adhere to laws limiting the interest amount they can charge, which varies by state. Additionally, they may be restricted in the number of loans they can make within a certain period.

Private money lending often offers faster approval and greater flexibility than traditional lending. Loans are approved much faster, and private money lenders can also offer more flexible loan terms.

Benefits of Getting a Private Money Loan

Private money loans offer several advantages, making them an attractive option for borrowers. Key benefits of getting a private money loan include:

Easier Qualification

Unlike traditional bank loans that heavily weigh your credit score and income, private money lenders concentrate more on the value of the property or asset you’re financing. This makes it much easier for borrowers with less-than-perfect credit or unique financial situations to secure the funding they need.

Fast Approval and Funding

Private money loans are known for their fast approval times. They can often be approved in just a few days. This quick turnaround is especially beneficial for real estate investors and house flippers who need to act quickly to take advantage of an opportunity like buying property for a new fix and flip project.

Flexible Terms

Private money loans often offer more flexible terms than traditional loans. These terms can include customized repayment schedules, interest-only payments, and other terms tailored to the borrower’s specific needs and situation. This personalized approach can make private money loans a more convenient and practical solution.

Things to Consider Before Getting a Private Money Loan

Private money loans can be a great tool for financing investments, but you should consider the following before proceeding:

- Slightly higher interest rates: Private money loans typically have higher interest rates than conventional loans. This is because private lenders take on more risk by financing borrowers with less-established credit or unconventional financial situations.

- Shorter loan terms: Unlike traditional loans with longer repayment periods, private money loans typically have shorter terms, similar to bridge loans. This means you’ll need to repay the loan within a shorter time frame, which can affect your cash flow and budgeting.

- Risks of defaulting on a private money loan: Defaulting on a private money loan can have serious consequences. For instance, you could lose the property or asset used as collateral. Private lenders may move quickly to foreclose on the property if you fail to make timely payments.

How to Find the Right Private Money Lender

Finding the right private money lender should be a top priority for borrowers. Let’s take a look at key steps to help you find a lender that meets your needs and offers favorable terms:

Seek Out Specialized Lenders

When looking for a private money lender, consider those who specialize in the type of loan you need — are you looking for real estate financing or business funding? Specialized private money lenders often have a better understanding of your industry and can offer tailored solutions.

Evaluate Terms & Conditions

Compare the terms and conditions offered by different private money lenders. Pay attention to the differences in interest rates, loan fees, repayment schedules, and any other terms that could impact your financial obligations. Choose a lender whose terms align with your financial goals and repayment capabilities.

Check Reputation & Reviews

Research the reputation of potential private money lenders. You can use reviews from previous clients to gauge customer satisfaction and reliability. A reputable lender with positive feedback is more likely to provide a smooth lending experience.

Review Legal & Regulatory Compliance

Ensure that the private money lender complies with legal and regulatory requirements in your state or jurisdiction. Verify their licensing and credentials to avoid dealing with unscrupulous lenders. Working with a compliant lender protects your rights and ensures transparency throughout the loan process.

Private Money Lending: FAQs

Can I get a private money loan with bad credit?

Yes, you can get a private money loan with bad credit. Private money lenders focus more on the value of the property or asset being financed rather than your credit score. This makes private money loans an accessible option for those with less-than-perfect credit who may have difficulty qualifying for traditional loans.

What types of properties can be financed with private money loans?

Private money loans can finance a variety of properties, including residential, commercial, and investment properties. This flexibility makes them a popular choice for real estate investors, house flippers, and developers looking to quickly secure funding for different types of real estate projects.

What are the typical interest rates for private money loans?

The typical interest rates for private money loans range from 9% to 15%. These rates are higher than traditional loan rates because the lender takes on more risk. However, the flexibility and speed of private money loans often outweigh the higher cost for many borrowers.

Do private money loans require a down payment?

Yes, private money loans usually require a down payment. The amount can vary, but borrowers typically need to put down at least 20% to 30% of the property’s value. This down payment reduces the lender’s risk and demonstrates the borrower’s commitment to the investment.

Get Approved for a Private Hard Money Loan

Private money loans are an excellent option for those needing quick and flexible financing. Unlike traditional bank loans, private money loans are funded by individuals or companies that evaluate your overall ability to repay the loan, focusing more on the value of the asset being financed rather than your credit score. These loans are especially popular among real estate investors, house flippers, and those with unique financial situations who need to secure funding as quickly as possible.

Source Capital offers a streamlined process for securing a private hard money loan. With same-day approvals, no debt-to-income requirements, and the ability to close in 7-10 days, Source Capital makes it easy for borrowers to secure hard money loans in California, Texas, Colorado, Minnesota, and Arizona to access the funds they need. Whether you’re dealing with less-than-perfect credit or unconventional income sources, Source Capital’s hard money loans ensure a quick and hassle-free financing solution.

As a State and Federally licensed lender, Source Capital has been in business since 2007 and is A+ rated with the Better Business Bureau. They are a 5-star rated lender on Google, Yahoo and Zillow and have funded over $550M in private loans.

Apply now to take advantage of this flexible lending option and move forward with your investment projects.