Google 5-Star Rated Direct Hard Money Lender

What Are Non-QM Loans?

Non-QM loans are an alternative to traditional mortgages for people who don’t qualify. There are several types of non-QM loans, including hard money loans and interest-only loans. Non-QM loans offer several benefits, including faster approval times and more flexibility.

If you’re planning on buying or refinancing a home but you don’t meet the requirements to get approved for a traditional mortgage, non-QM loans can help you get access to the funds you need to purchase a home.

Before you apply for a non-QM loan, it’s important to understand how they work and how they’re different from traditional loans. Understanding different loan programs can help you choose the best loan based on your finances.

If you’re considering a non-QM loan or are wondering about non-QM loan requirements, we’ve got you covered. Keep reading to learn more about non-QM loans, their benefits, and who they’re for.

- Understanding Non-QM Loans

- Types of Non-QM Loans

- Who Should Consider a Non-QM Loan?

- How to Qualify for a Non-QM Loan?

- Non-QM Loan: FAQs

- Secure a Non-QM Hard Money Loan

Understanding Non-QM Loans

Non-QM loans, or non-qualifying mortgages, are home loans that are designed for people who don’t meet traditional mortgage requirements. You may be able to apply for a non-QM loan if you weren’t approved for a mortgage because of your credit, employment, or issues verifying your income.

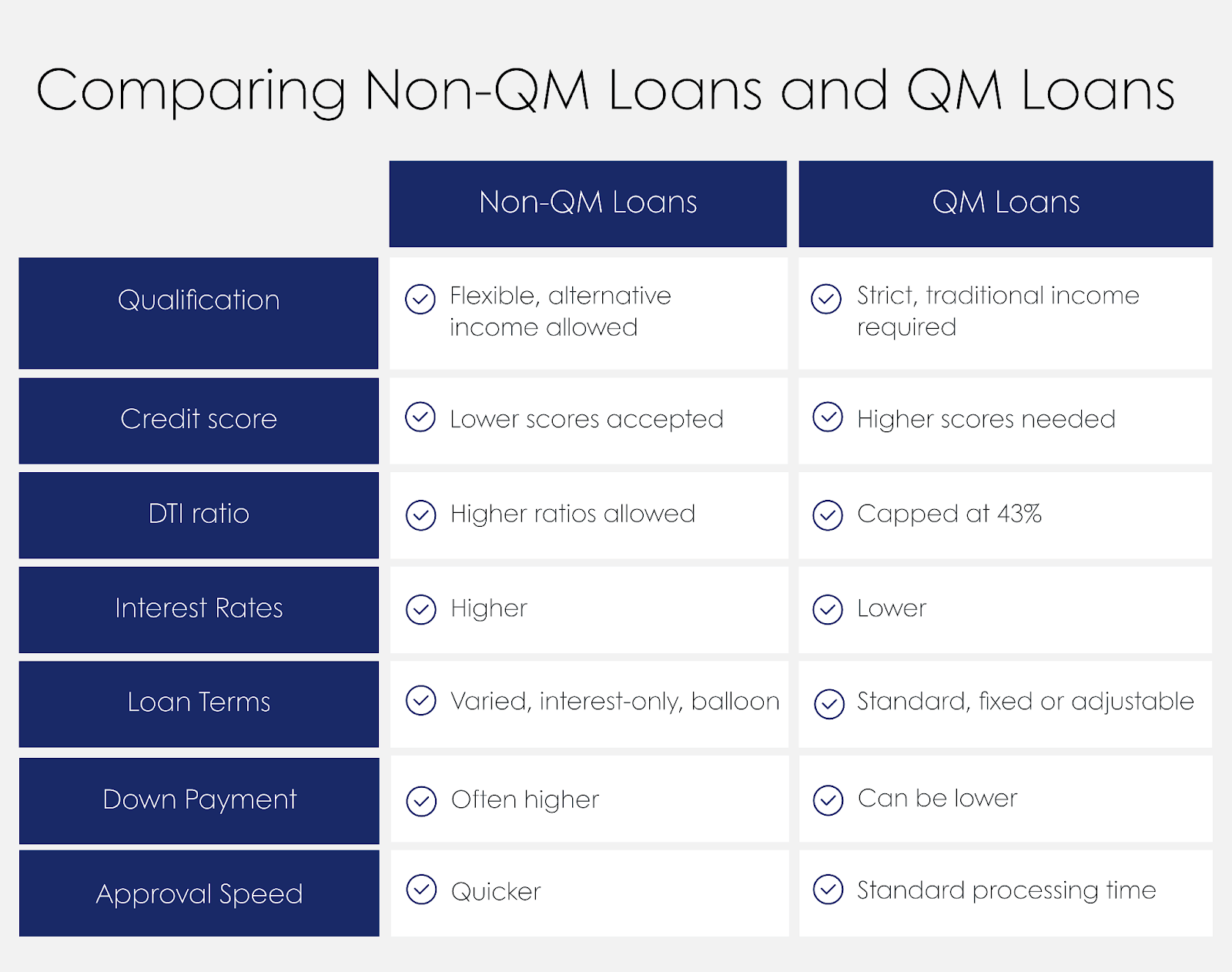

Non-QM Loan vs. QM Loans

A QM loan, or qualifying mortgage, is the traditional loan most people take out when buying or refinancing a home. To qualify for a QM loan, you need to verify your income and identity, have a good credit score, have minimal debt, and provide bank statements. Because QM loans have stricter requirements, they typically offer more favorable terms. Traditional mortgages offer competitive interest rates and better consumer protection thanks to the Dodd-Frank Act.

Non-QM loans are specifically for people who can’t get approved for a traditional mortgage. You don’t have to meet as strict of credit and debt requirements and you don’t have to verify your income. Because non-QM loans have fewer qualification parameters, they may have higher interest rates and fees. Additionally, you don’t get the same consumer protection like you do with a traditional mortgage.

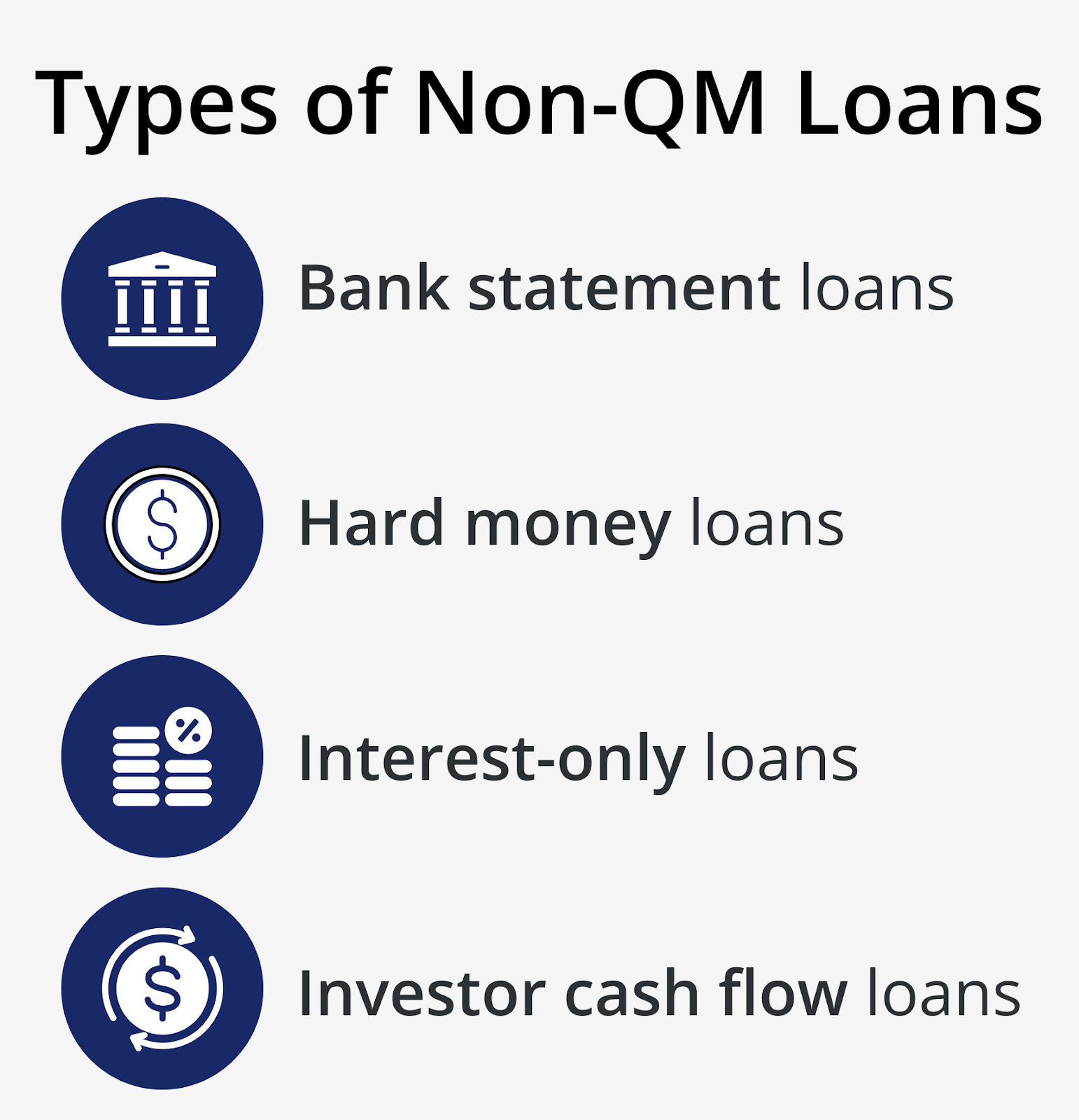

Types of Non-QM Loans

Unlike bridge loans and other types of loans, non-QM loans are broad. There are actually several types of non-QM loans you can apply for. You can learn more about the types of non-QM loans below.

Bank Statement Loans

Bank statement loans are an alternative for people who can’t provide tax returns to apply for a loan. Instead of using your tax returns to verify your income, you can provide bank statements. These loans are often ideal for people who have non-traditional sources

Hard Money Loans

Hard money loans are short-term loans that use assets as collateral. If you don’t have the debt-to-income (DTI) ratio, credit score, or income to qualify for a home loan, you can use an asset as collateral to secure a loan. Homes are commonly used as assets for hard money loans, allowing homeowners to use their home to invest in another property.

Interest-Only Loans

An interest-only loan is similar to a traditional mortgage, but the lender has to make payments toward the interest only for a set period of time. This interest-only period usually lasts for several years, which means your monthly loan payments are lower for that period. These loans can be harder to qualify for because you can make smaller monthly payments.

Investor Cash Flow Loans

If you’re planning on purchasing a rental property that generates cash flow, you can use that projected cash flow to secure a loan. The amount you can borrow is based on the cash flow your property generates, allowing you to take out a loan that your monthly rent payments can help cover.

Who Should Consider a Non-QM Loan?

If you’re thinking about buying a home but can’t qualify for a traditional mortgage, a non-QM loan might be the ticket. Non-QM loans usually have less stringent requirements, which means you don’t have to meet the same criteria to get approved. Here are some of the types of individuals who might consider a non-QM loan:

- Self-employed individuals with irregular income can use bank statements to secure a loan without tax returns. If you generate income from various sources and you’re having trouble verifying your income with a traditional lender, non-QM lenders can be a smart alternative.

- Borrowers with high net worth but low reportable income often have trouble getting approved for traditional mortgages because of their income. If your net worth is high but you’re having trouble securing a loan, you can use assets as collateral or apply for an investor cash flow loan.

- Individuals with recent credit changes — such as foreclosure or bankruptcy — can have a hard time borrowing money. Since non-QM loans have less strict requirements, you can get approved for a non-QM loan even if you have recent negative items on your credit report.

- Real estate investors with assets can take out hard money loans for rental properties to invest in several properties in a short period. Alternatively, investors can use investor cash flow loans to borrow money based on the project cash flow of the properties they’re investing in.

- Individuals who lack the income, credit score, or DTI ratio to get approved for a traditional mortgage loan still have access to other options with non-QM loans.

Benefits of Getting a Non-QM Loan

From DSCR loans to hard money loans, there are several benefits to getting approved for a non-QM loan. Let’s take a look at some of the benefits of non-QM loans vs. QM loans.

Flexible Qualification Criteria

Flexibility is by far the biggest benefit of choosing a non-QM loan over a QM loan. If you can’t get approved for a traditional loan for any reason, you can still apply for a non-QM loan. There are also several types of non-QM loans, which means you can find a loan that works for your financial situation. Whether you have assets or plan on investing in rental properties, there’s a non-QM loan for you.

Customized Loan Terms

Traditional mortgages are rigid, which means there’s not much you can do to get more favorable loan terms or save money on your loan. Non-QM loans, on the other hand, can be more flexible when it comes to loan terms. Interest-only loans allow you to make payments toward interest only for a period, resulting in lower monthly payments. Some non-QM loans also include a balloon payment option that allows you to pay a large sum at the end of your loan to reduce your monthly payments.

Access to Larger Loan Amounts

You might have trouble borrowing enough money to buy a house with a traditional mortgage, but that doesn’t rule out non-QM loans. Many borrowers can get access to more money through non-QM loans, so you can start investing in properties or make your dream of being a homeowner come true.

Faster Approval Process

Getting approved for a mortgage can take a while, but non-QM loans are usually approved faster. Some lenders can review and approve your non-QM loan application in as little as a day, so you can find out if you’re approved and make a purchase sooner.

How to Qualify for a Non-QM Loan

Qualifying for a non-QM loan isn’t rocket science, but there are some basic requirements you should know before you apply. Here’s what you may need to apply for a non-QM loan:

- Bank statements

- Proof of assets

- Alternative income verification

- Credit report

Improving your credit score or making a larger down payment can make it easier to get approved for a non-QM loan. You can use a credit monitoring app to check your credit score and implement good credit habits to improve it.

Look for a lender who has experience with non-QM loans and gets positive reviews online. Choosing the right lender is a key part of getting the right loan.

Non-QM Loan: FAQs

Are non-QM loans safe?

Non-QM loans generally carry more risk than traditional mortgages, but they’re perfectly safe if you’re responsible. Don’t borrow more than you can repay and make on-time monthly payments to reduce your financial risk.

Can I refinance a non-QM loan into a QM loan?

Depending on your financial situation and credit score, you may be able to refinance a non-QM loan into a traditional mortgage.

How long does it take to get approved for a non-QM loan?

Getting approved for a non-QM loan can take anywhere from a few minutes to a few days. At Source Capital, we offer same-day approvals to make sure you get access to your money the moment you need it.

Secure a Non-QM Hard Money Loan

Are you having trouble getting approved for a traditional mortgage? If you’ve got assets you can use as collateral, you may want to consider a non-QM hard money loan. Non-QM loans are flexible, so you can get approved even if you don’t qualify for a QM loan.

At Source Capital, we offer non-QM loans with competitive interest rates, no prepayment penalty, and same-day approval. Contact us to learn more or apply now to see if you qualify for a non-QM hard money loan.