Google 5-Star Rated Direct Hard Money Lender

DSCR Loan: Everything You Need to Know

Securing a loan can be tough — especially when you don’t meet income requirements. If you’re having trouble securing a traditional mortgage loan, there are other routes you can take.

DSCR loans are one option for people who don’t have the personal income to qualify for a home loan. If you’re investing in a rental property, you can apply for a DSCR loan instead of a traditional mortgage.

You may be wondering how these loans work and what the DSCR loan requirements are. We’ll break down everything you need to know in this brief guide. You can use the links below to jump ahead to a particular section.

- What is a DSCR Loan?

- How Do DSCR Loans Work?

- What Are DSCR Loans Typically Used For?

- Pros & Cons of DSCR Loans

- DSCR Loan Requirements

- How to Get a DSCR Loan

- Secure Real Estate Funding with Ease

What is a DSCR Loan?

A DSCR loan, or debt service coverage ratio loan, is a type of non-traditional mortgage used primarily for investment properties. The key factor in qualifying for a DSCR loan is the property’s cash flow rather than the personal income of the borrower.

How Do DSCR Loans Work?

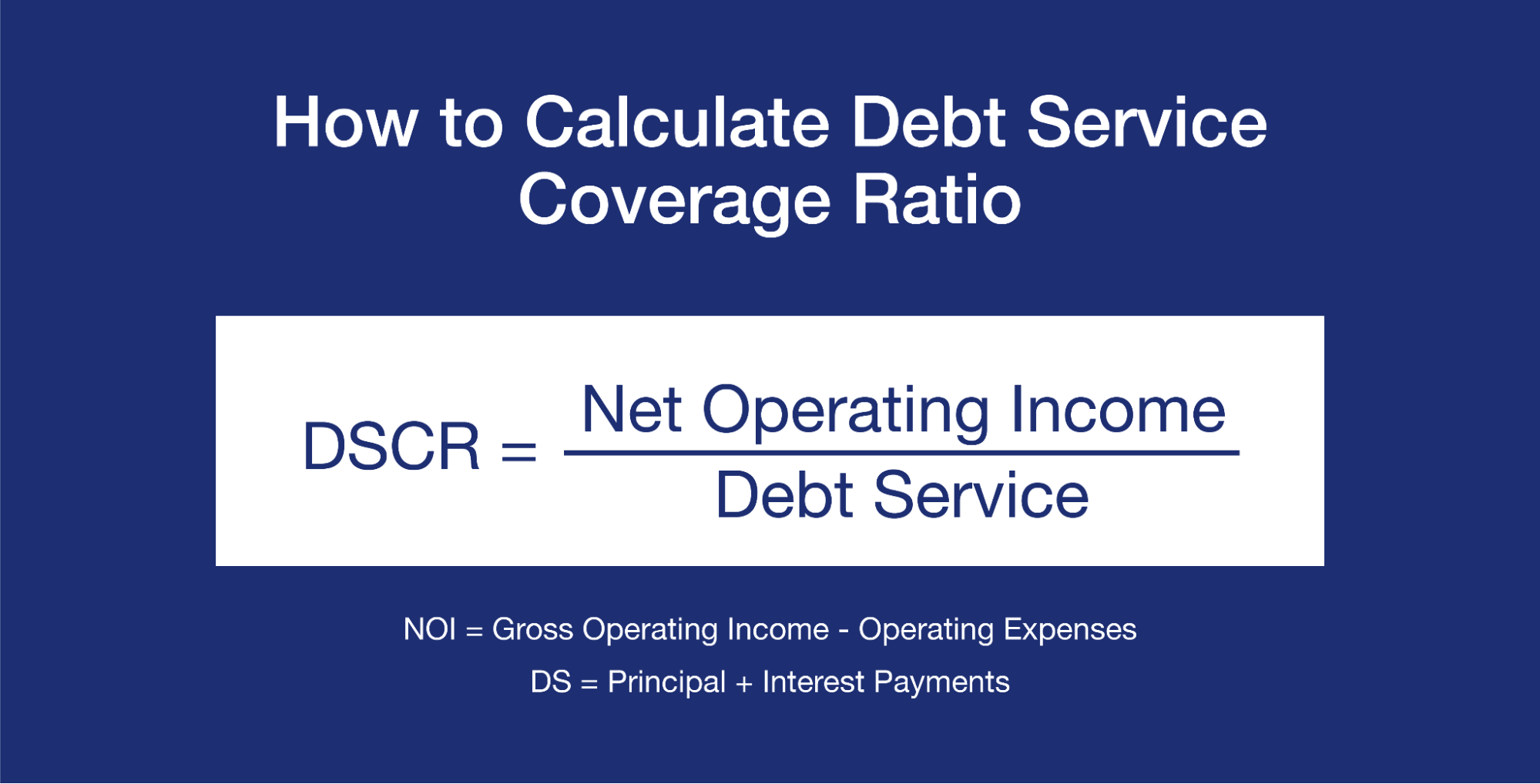

When applying for a DSCR loan, your eligibility is determined by the debt service coverage ratio itself, an essential financial metric that lenders use to assess your property’s cash flow and its ability to cover debt obligations.

DSCR is calculated by dividing the property’s annual net operating income (NOI) by its annual total debt service (the total amount of principal and interest payments for the year).

For example, if a property generates $150,000 in annual rent and has $100,000 in annual debt payments, the DSCR would be 1.5. Usually, lenders require at least a DSCR of 1.0 for a DSCR loan.

What Are DSCR Loans Typically Used For?

Real Estate Financing

If you’re investing in rental property, you can use a DSCR loan to secure a loan even if you don’t meet personal income requirements. Once your DSCR loan is paid off, you can continue renting out your property for profit.

DSCR loans can also be used for commercial buildings and other types of real estate that generate income.

Business Expansion

Business owners may take out DSCR loans to expand business operations or purchase new equipment. Commercial DSCR loans can also be used to invest in commercial property to expand your business.

Pros & Cons of DSCR Loans

DSCR loans can help you secure funding for rental property, but they’re not right for everyone. Take a look at some DSCR loan pros and cons before you make your decision.

Pros

When you apply for a DSCR loan, your approval is based on what the property earns rather than your personal income. You can also secure DSCR loans with a lower credit score. If you don’t meet the income or credit score requirements for a traditional loan, you may still meet DSCR loan requirements.

You generally don’t have to verify your income or provide W-2s and tax returns when you apply for a DSCR loan. Other loans and loan programs typically require a lot of paperwork that isn’t necessary for DSCR loans.

If you want to invest in multiple properties, it’s easier with DSCR loans. As long as your DSCR is high enough, you can continue investing in rental properties.

Cons

DSCR loan rates are typically higher than conventional loans, which means you end up paying more interest. While this difference may seem marginal, it can add up quickly when you’re taking out a big loan for a rental property.

In many cases, you have to make a larger down payment with a DSCR loan than a traditional mortgage. While down payments vary depending on the lender you choose, you may have to put as much as 20% down with a DSCR loan.

If your property isn’t performing up to expectations, it can be difficult to repay a DSCR loan. This is why it’s important to maintain your rental properties and actively search for tenants when they’re vacant.

Loan conditions are often less favorable with DSCR loans — and that’s not limited to interest rates. If you decide to repay your loan early, you may face early repayment penalties with a DSCR loan.

DSCR Loan Requirements

Whether you’re taking out a hard money construction loan or a DSCR loan for a rental property, requirements vary by lender. The guidelines below can help you understand what lenders look for when you apply for a DSCR loan.

Property

If you want to secure a DSCR loan, you need a property that generates rental income. That property must generate enough rental income to cover 100% of debt payments — which is also known as a DSCR of 1.0. This is generally the minimum requirement for lenders.

Lenders may also want to do a formal appraisal and look at profit and loss statements for the property before giving you a loan. In some cases, you may need to provide documentation of current rental agreements.

Finances

While your credit score isn’t as important with DSCR loans, some lenders will deny your loan if your credit score is too low. Your loan may also be denied if you don’t have reserves to make debt payments if your property is vacant for a period of time.

Down Payment

Most DSCR lenders require a higher down payment, so you need to have cash to secure a DSCR loan. Depending on the lender you choose, you can expect your down payment to be anywhere from 20 to 30% of the purchase price of your property.

Legal & Compliance

Since DSCR lenders rely on your property income to collect debt payments, you need to have property and liability insurance at all times. Your home must also meet all local zoning and safety regulations.

How to Get a DSCR Loan

Applying for a DSCR loan isn’t rocket science, but there are a few things you should do before you apply. Here’s what you can do before you talk to a lender for a DSCR loan.

Evaluate Your Property

Start by evaluating the property you’re considering purchasing. Divide the potential rental income by the monthly payment you’d have to make with a DSCR loan. If this number is higher than 1, you know that property generates enough income to cover your DSCR loan.

Gather Financial Documentation

Before you can get approved for a DSCR loan, lenders will want to look at several documents including property lease agreements, expense reports, and current rental records. You don’t have to provide a W-2 or income tax return, but make sure you have all the necessary financial documents related to the property you want to invest in.

Shop For Lenders

Once you find an ideal rental property and gather all the necessary documents, you’re ready to start applying for loans. Before you submit any applications, take some time to research DSCR lenders and find the best loan offer you can get. You can compare loan quotes to figure out which loan is best, looking at everything from interest rates to specific loan terms.

Submit Your Loan Application

After you decide on a DSCR lender, it’s time to apply for a loan. When you apply for a loan, make sure you provide accurate information and all the necessary documentation. Mistakes can extend the application process. If you need help applying, a DSCR lender can help.

Undergo Property & Loan Review

Now that you’ve applied for a loan, your lender will want to review the property and loan before finalizing it. This may include a formal appraisal and a review of profit and loss statements for that property.

Finalize the Loan & Make Regular Payments

Last but not least, it’s time to finalize your DSCR loan so you can purchase your rental property. Make sure you maintain your rental property and minimize vacancies so you can make loan payments on time.

If you have any questions about your loan, take a moment to ask them before finalizing your loan.

Secure Real Estate Funding with Ease

DSCR loans can benefit borrowers who have trouble qualifying for a traditional loan, but it’s important to weigh your options before you apply for a loan or purchase a rental property. Qualifying for a hard money loan may be faster and easier.

At Source Capital, we work hard to empower you to do more financially. Our hard money loans offer a faster approval process and less stringent requirements, so you can secure the funding you need. Apply now or reach out to learn more about our hard money loans.