Google 5-Star Rated Direct Hard Money Lender

How a Deed of Trust Works: Essential Information for Borrowers

A deed of trust helps borrowers secure loans for real estate transactions. In the same way a mortgage is an agreement with your lender, the deed of trust outlines the terms and conditions of the loan.

Understanding how a deed of trust works is crucial for borrowers because it can affect the foreclosure process and all parties’ rights.

Keep reading to learn more about the deed of trust definition, how it works, and why it’s important.

- What is a Deed of Trust

- How a Deed of Trust Works

- Deed of Trust vs. Mortgage Similarities vs. Differences

- Benefits of Trust Deeds

- Trust Deed Considerations

- Steps to Take if You Have a Deed of Trust

- Deed of Trust: FAQs

- Secure Fast Funding with Hard Money Loans

What is a Deed of Trust

A trust deed, or deed of trust, is a legal agreement between the three parties involved in a real estate loan: the trustor (borrower), the trustee (neutral third party), and the beneficiary (lender).

Whether you’re taking out a hard money loan for rental properties or a second home loan, a deed of trust gives the title of a property to the trustee, typically a mortgage title company or broker, that holds it “in trust” as collateral for the loan provided by the lender.

The deed of trust includes important details such as the loan amount, the repayment schedule, the interest rate, and any conditions or covenants related to the loan. Like a mortgage, a deed of trust serves as the agreement between the borrower and lender and may be used for any and all types of loan programs. Depending on where you live, you may be required to use a deed of trust rather than a mortgage. If the borrower doesn’t repay the loan as agreed (also known as defaulting on the loan), the trustee can initiate the non-judicial foreclosure process to sell the property and satisfy the debt.

This legal document provides security for the lender, ensuring that the property can be sold to recover the remaining loan amount in case of default, while the borrower retains equitable title and the right to use the property as long as they continue to repay their loan.

Key Components of Trust Deeds

A trust deed secures real estate loans and comprises several key elements that outline the agreement and responsibilities of all three parties involved. Key components include:

- Promissory note: The promissory note outlines the terms of the loan in the same way a mortgage agreement would. It includes the amount borrowed, interest rate, repayment schedule, and maturity date.

- Property description: This is a detailed legal description of the property being used as collateral.

- Power of sale clause: This clause is a provision in which the trustee has the authority to sell the property in a non-judicial (no courts) foreclosure if the borrower defaults on the loan.

- Default provisions: These are the conditions under which the borrower is considered in default, such as missed payments or breach of conditions like maintaining the property and paying property taxes.

- Reconveyance clause: This clause obligates the trustee to transfer the title back to the borrower once the loan is fully repaid.

How a Deed of Trust Works

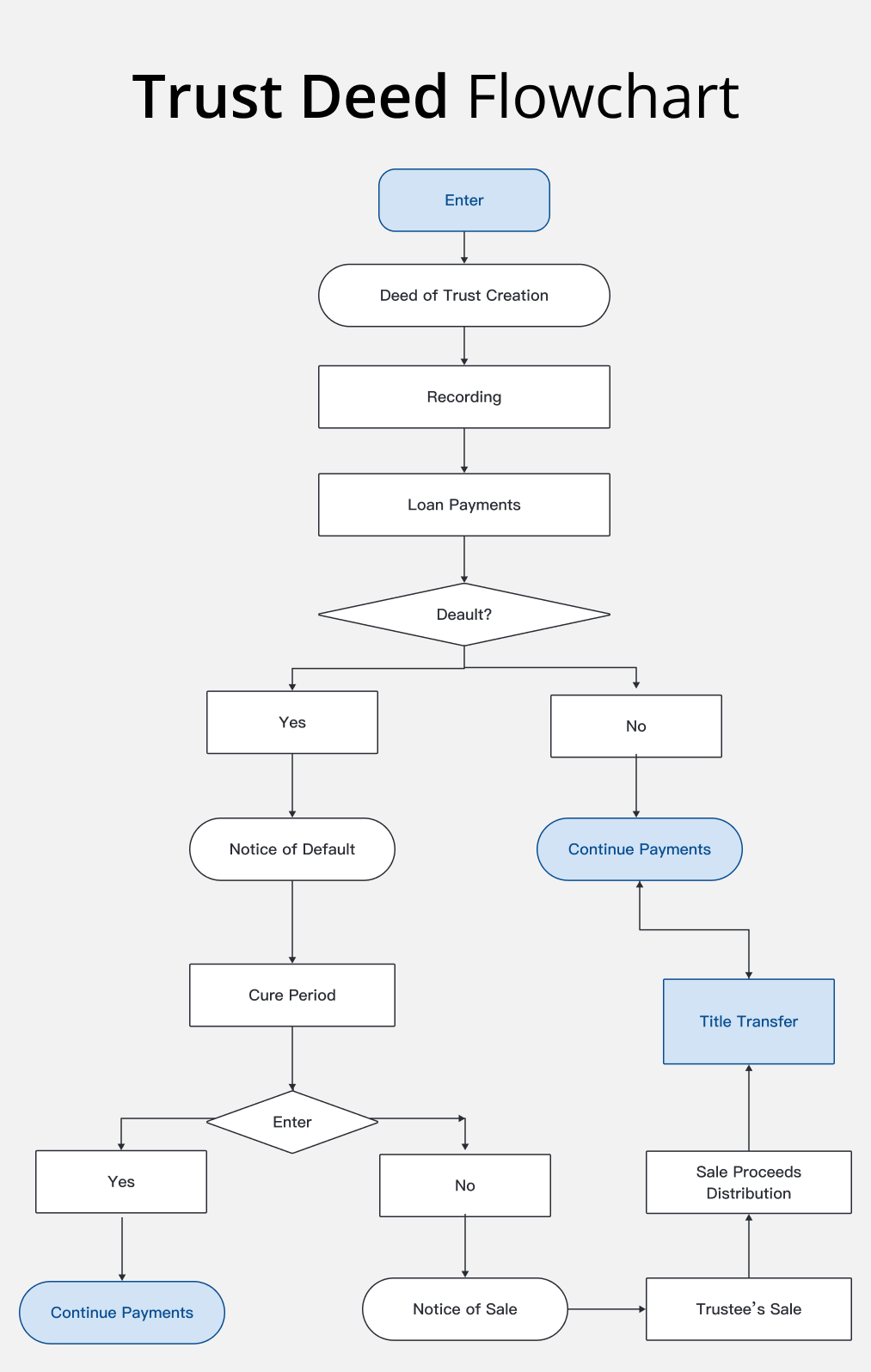

When someone takes out a loan to purchase property, the lender requires some way to secure their interest in case the borrower defaults. Instead of a traditional mortgage, a deed of trust transfers the title of the property to a neutral third party, the trustee, who holds it as collateral for the loan. The borrower retains the equitable title and right to use the property as long as they adhere to the terms of the loan.

Throughout the loan term, the borrower makes regular payments to the lender, which includes interest and principal. If the borrower fails to do this, the deed of trust gives the trustee the authority to begin the non-judicial foreclosure process. This process involves selling the property at a public auction to repay the outstanding loan amount.

Once the borrower repays the loan, the trustee gives them the legal title back, releasing the lien on the property. This process protects the lender and provides the borrower with a clear path to property ownership once they meet their financial obligations.

In many states lenders can choose between a deed of trust or mortgage, while in others only trust deeds may be available.

Deed of Trust vs. Mortgage Similarities vs. Differences

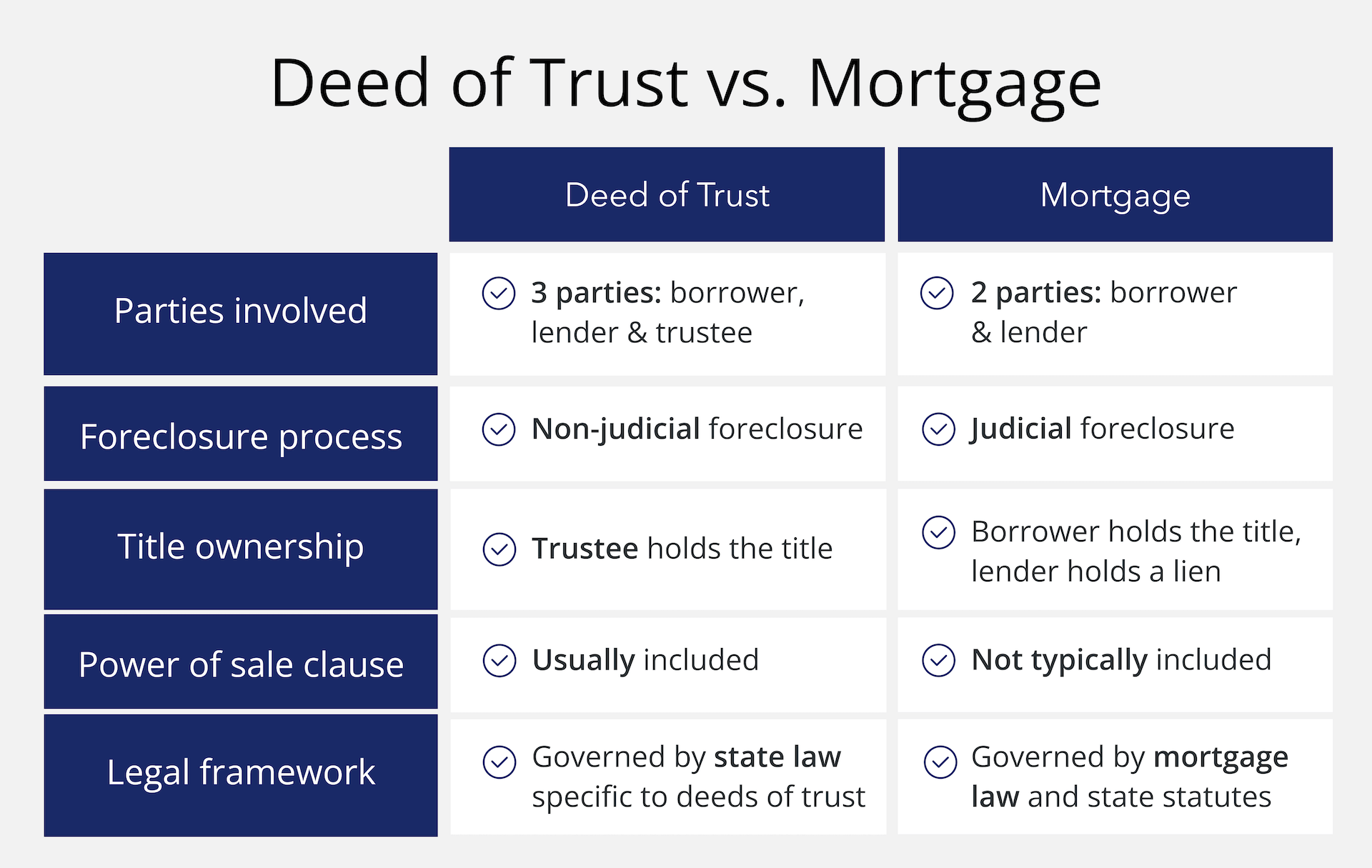

Comparing a deed of trust vs. mortgage, both are methods for securing real estate loans, ensuring the lender’s claim on the property should the borrower default on the loan. Both mortgages and deeds of trust are governed by state laws and require proper execution and recording to be valid and enforceable. However, there are key differences between a deed of trust vs. mortgage, including:

- Parties involved: The deed of trust involves the trustor, trustee, and beneficiary. On the other hand, mortgages only involve two parties — the borrower and the lender.

- Foreclosure process: A deed of trust allows for non-judicial foreclosure, which is faster and less expensive because it doesn’t require permission from the courts. However, a mortgage generally requires judicial foreclosure, which involves court proceedings and can be more costly and time-consuming.

- Title holding: With a deed of trust, the third-party trustee holds the property’s title until the loan is repaid. Conversely, borrowers with a mortgage retain legal title to the property while the lender holds a lien on the property.

Benefits of Trust Deeds

A deed of trust offers several advantages over mortgages for borrowers and lenders:

Speed & Efficiency

With a deed of trust, the trustee can sell the property without involving the courts. This streamlined process reduces the time it takes to resolve a default, allowing for quicker resolution and less stress for the borrower compared to the lengthy judicial foreclosure process associated with mortgages.

Reduced Legal Costs

The non-judicial foreclosure process also results in lower legal fees because it bypasses the court system. Avoiding court fees and lengthy legal procedures can save borrowers money, reducing the financial burden if foreclosure becomes necessary.

Clear Foreclosure Path

A deed of trust provides a clear and predefined path for foreclosure, reducing ambiguity and potential disputes. The trustee manages the foreclosure process, ensuring that the terms agreed upon in the trust deed are followed precisely. This clarity can prevent level challenges and streamline the resolution of defaults to provide borrowers with a more straightforward and predictable process.

Trust Deed Considerations

When considering a deed of trust, borrowers must understand the key clauses — the power of sale and reconveyance. The power of sale clause gives the trustee the ability to sell the property if you default on your loan. This means that the property can be sold to satisfy the debt, so it’s important to make timely loan payments.

Equally important is the reconveyance clause, which activates once the loan is fully repaired. This clause requires the trustee to transfer the legal property title back to you, release the lien, and confirm that you’ve paid off your loan. Understanding this clause ensures that your ownership of the property is fully recognized, and the lender can’t make any claims against it.

Steps to Take if You Have a Deed of Trust

If you have a deed of trust securing your real estate loan, there are several steps you should take to make sure you fulfill your obligations and protect your interests:

Ensure Proper Recording

Verify that the deed of trust is correctly recorded with the county recorder’s office. Proper recording establishes the validity of the document and provides notice to the public of the lender’s lien on the property.

Review the recording details to confirm accuracy and completeness, as any errors could affect the enforceability of the deed of trust.

Maintain Communication with Your Lender

Open and ongoing communication with your lender can help you resolve payment issues quickly if you encounter any financial challenges or anticipate difficulty making payments.

Notify your lender as soon as possible to discuss your situation and find alternative arrangements or solutions that can help you avoid default and foreclosure.

Stay Current on Payments

Keeping up with your loan payments ensures you avoid defaulting, which triggers foreclosure proceedings. Making payments on time according to the terms outlined in the deed of trust will prevent any misunderstandings that can make your lender think you aren’t paying your loan off.

Deed of Trust: FAQs

Can I sell my property if there is a trust deed on it?

Yes, you can sell your property if there is a deed of trust on it. In these cases, you’ll use the sale proceeds to repay the outstanding loan balance, and you’ll keep anything left over.

How do I remove a deed of trust from my property?

The only sure way to remove a deed of trust from your property is through reconveyance. When you repay the loan in full, the lender gives you a document detailing your satisfaction of the deed of trust. This document is your evidence that the loan has been repaid. You or your lender can then request a reconveyance from the trustee named in the deed of trust, and a new document will be filed with the county recorder’s office removing the deed of trust from the property’s title.

What is a 1st trust deed?

A 1st trust deed is the first lien or loan secured by the property, where the lender holds the primary lien position. This means that in the event of default and foreclosure, the lender with the 1st trust deed has the first claim on the property’s proceeds from the sale.

What is a 2nd trust deed?

A 2nd trust deed is essentially a second loan using the same property as collateral. This loan is only repaid after the 1st trust deed is fully satisfied in the event of foreclosure.

Can a deed of trust be refinanced?

A deed of trust can be refinanced, replacing the original loan with a new one. Many people do this to obtain more favorable terms like a lower interest rate or a longer repayment period. Refinancing requires you to go through a new loan application process to get approval. Then, once the new loan is funded, it’s used to pay off the original loan and a new deed of trust is recorded to secure the refinanced loan.

Secure Fast Funding with Hard Money Loans

A deed of trust isn’t that much different from a mortgage loan — it just requires a third party that holds the title as collateral until the loan is paid off. In many states lenders can choose between a deed of trust or mortgage, while in others only mortgages may be available.

When traditional financing isn’t an option, or you need quick access to capital, Source Capital can help with hard money loans. We offer both 1st and 2nd trust deeds, allowing you to leverage your property’s equity. Experience the convenience of same-day approvals and closing in just 7-10 days so you get the funding you need without delay. Apply now to see if you qualify for a hard money loan.

Check out the latest piece from Card Rates on Source Capital!