Google 5-Star Rated Direct Hard Money Lender

Can You Get Loans after Bankruptcy?

Bankruptcy can be a stressful and frustrating process. The good news is, there’s hope after. You can get a loan after bankruptcy, though you will need to wait some time. Typically, making 12-24 months of on-time payments can help rebuild your credit score and set you up to be approved for a loan.

How Does Bankruptcy Impact Borrowing Power?

Bankruptcy may release you from your debt, but it does have some lasting effects. A record of bankruptcy stays on your credit record for up to 10 years. Traditional lenders often interpret a past bankruptcy as an inability to manage obligations. It may cause them to cut available credit lines and raise rates.

Fortunately, the mark of bankruptcy isn’t permanent. Each time you make an on-time payment or responsibly open a new account, it chips away at the negative impact of your bankruptcy.

The Effect of a Bankruptcy Discharge on Credit Reports

In the event of a bankruptcy, credit bureaus will record either a Chapter 7 or Chapter 13 discharge on your credit report. Your discharged debts will read “included in bankruptcy,” and show as closed with zero remaining balance. Keep in mind that, if your debt is secured by collateral, you may choose to keep the collateral by affirming the debt. In this case, your account may appear “open”.

Typically, your initial bankruptcy will drop your credit score 100 points or more. That said, with consistent on-time payments, you can begin to recover your score.

Bankruptcy Waiting Periods and Fresh Start Credit

After a bankruptcy, you’ll need to wait a certain amount of time before applying for most loans again. These timelines are typically:

- Federal Housing Administration (FHA) Loan: 2 years

- Veterans Affair (VA) Loan: 2 years

- US Department of Agriculture (USDA) Loan: 3 years

- Conventional loans: 4 years

- Hard Money loans: No set waiting period

Even after this waiting period, traditional lenders typically look for 12-24 months of on-time payments before issuing a loan. Hard money lenders, on the other hand, may be willing to issue a loan right away, as long as your collateral property holds enough value.

Secured vs. Unsecured Loans for High-Risk Borrowers

For borrowers with a history of bankruptcy, secured loans like hard money loans present a ready solution. Rather than relying on a borrower’s creditworthiness and income to secure a loan, these loans are secured by physical property like a home or building. Taking out a hard money loan may positively impact your credit score, too. A series of on-time payments on your hard money loan can serve as a useful credit-building tool.

When Is the Right Time to Seek Credit After Bankruptcy Discharge?

There’s no set “right” time to get a loan after a bankruptcy discharge; it’s a matter of balancing patience with momentum. If you wait too long after bankruptcy, you can stall your progress in rebuilding your credit score. But if you try to soon, you risk loan denial and hard loan inquiries that can affect your score.

Typically, a 12-24 month track record of on-time payments on new accounts usually signals loan readiness. It’s a good idea to monitor your credit score with the goal of reaching the mid-600s before applying for a loan, as well as stay under 30% of your available credit before applying for a traditional loan.

Understanding Chapter 7 vs. Chapter 13 Discharge Periods

Your discharge period depends on whether you file for Chapter 7 or Chapter 13 bankruptcy. Chapter 7 bankruptcy, also known as a liquidation, discharges debts without the possibility of repayment. Chapter 13, on the other hand, allows debtors to reorganize their debts and make a repayment plan. Their discharge periods are as follows:

- Chapter 7 bankruptcy: Discharged after 4-6 months after filing

- Chapter 13 bankruptcy: Discharged after 3-5 years of repayment

Waiting periods for mortgages and other loans are measured from the discharge date, not the filing date. Lenders also have the ability to extend their own overlays beyond these standard guidelines.

Signs Your Credit Score Is Ready for a New Loan

Wondering if you may be ready to get a loan after bankruptcy? Here are some signs that you may be ready for a new loan:

- Your credit score is consistently above 640

- You have multiple active credit accounts in good standing

- You have no recent late payments

- You have at least one long-term line of credit (12 months or longer)

- Your credit utilization is less than 30%

- You have a stable income history

Thin Credit File Solutions and Early Steps

If you’re looking to establish a secure payment history, but don’t have any open lines of credit due to your past bankruptcy, consider these options:

- Hard money loans: For property owners looking to endeavor into real estate investment, a hard money loan can be a good way to rebuild credit. Hard money lenders tend to be forgiving to those with poor credit history, including bankruptcies.

- Credit-builder loans: These loans are designed specifically for those who need to improve their credit scores. You don’t receive your loan funds upfront. Instead, you’ll get funded after making between 6 and 24 months of payments.

- Third-party payment services: Another option is to pay rent and utility payments to third-party services that report to credit bureaus.

Types of Loans Available after Bankruptcy

Looking to get a loan after bankruptcy? Read on to learn the available options and find a loan that best suits your personal goals, whether in homeownership, vehicle purchasing, personal expenses, or investing.

Hard Money Loans

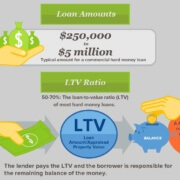

Whether you’re a seasoned property investor or looking for your first foray into real estate, hard money loans present a ready solution. The only prerequisite is that you have meaningful equity in a property that can be used as collateral.

- Minimum wait time after bankruptcy: None

- Minimum credit score: None

- Maximum loan amount: $5M

FHA Loans and Second-Chance Mortgages

For those looking to become homebuyers, FHA loans are a good solution. These loans are backed by the Federal Housing Administration and available for homes that will be used as a primary residence.

- Minimum wait time after bankruptcy: 2 years after Chapter 7 discharge, 1 year after Chapter 13 with extenuating circumstances

- Minimum credit score: 580 for 3.5% down, 500 for 10% down

- Maximum loan amount: Varies by region and property type, maxes at $3.4M for 4 unit properties in Alaska, Hawaii, and the US Virgin Islands

VA Loans Post-Bankruptcy

VA loans are available to veterans, active-duty service members, and some surviving spouses. Rather than directly funding loans, the VA guarantees a portion of the loan to the private lender to allow for better terms for borrowers.

- Minimum wait time after bankruptcy: No mandatory requirements, but lenders typically wait 2 years

- Minimum credit score: Typically 620, some lenders allow 580 for borrowers with a low debt-to-income ratio

- Maximum loan amount: $806,500

Secured Auto Loans and Collateral Requirements

If you’re interested in getting a loan for a car purchase, you likely have a range of different options. The typical expectation on down payments for these loans is between 10% and 20%. Your best choice is typically a credit union auto loan, which offers more competitive terms. Use “Buy here, pay here” dealerships as a last resort, as these typically have very high APRs and limited consumer protections.

Unsecured Personal Loans for Bankruptcy Filers

There are a range of online and peer-to-peer lenders available who may offer personal loans with APRs between 15% and 30%, depending on income and time since discharge. It may be a better idea to look for credit unions that provide members with small-dollar personal loans with more reasonable rates.

SBA and Small Business Loans after Chapter 7

Small business loans are available to those looking to start, grow, or refinance a business. For your best possible outcome, write a strong business plan, include cash-flow projections, and provide ample evidence of industry experience.

- Minimum wait time after bankruptcy: 2 years

- Minimum credit score: Typically around 680

- Maximum loan amount: Varies greatly

Frequently Asked Questions

Can I Get a Mortgage Immediately after Bankruptcy?

While you typically can’t get a mortgage immediately after bankruptcy, you may be able to get a hard money loan. These loans are available for those looking to purchase a range of properties and secured using existing property as collateral.

How Soon Can I Obtain a Personal Loan after Bankruptcy?

There’s no set waiting period for personal loans after bankruptcy, but most lenders like to see one or two years of responsible finances before they issue a loan.

Will My Interest Rates Be Significantly Higher on my loan after I file for Bankruptcy?

Yes, you can typically expect your loan interest rate to be much higher after bankruptcy because you’re considered to be a high risk borrower.

What Are the Waiting Periods for FHA and VA Loans after Bankruptcy?

Waiting periods for FHA and VA loans after bankruptcy are as follows:

- FHA loans: 2 years after Chapter 7 discharge, 1 year after Chapter 13

- VA loans: No set minimum, but lenders typically wait around 2 years before approving a loan

Can I Use a Co-signer to Improve Approval Odds?

Using a co-signer when applying for a loan after bankruptcy can significantly improve your approval odds. For your lender, your cosigner acts as an insurance policy on your loan in case you default.

Conclusion: Loans after Bankruptcy Are Within Reach

While bankruptcy can majorly impact your credit score, there is still hope of securing a loan in the future. With each on-time payment and saved dollar, you can rebuild your credit score and inspire trust in your lender. Disciplined planning and informed choices can help you unlock investment, auto, personal or business financing, even after bankruptcy.