Google 5-Star Rated Direct Hard Money Lender

The 9 Best Hard Money Lenders California (Market Breakdown)

The California real estate market is steadily growing, with booming markets like San Francisco, Los Angeles and San Diego leading the way. As the real estate market continues to grow, private, asset-based financing becomes an increasingly important resource for real estate investors.

There are several factors to consider when choosing a loan, including speed, flexibility, loan sizes, program variety and reputation. Discover how hard money lenders in California can help you make your next real estate investment a reality.

What Is a Hard Money Lender?

Hard money lenders are private, asset-based lenders who provide loans for real estate investors. Unlike traditional lenders who focus on your personal credit, hard money lenders focus on the value of your real estate. Hard money loans are a type of secure loan, which means they’re backed by an asset.

Hard money lenders in California offer different types of loan programs based on your needs. Bridge loans are ideal for short-term hold periods, fix-and-flip loans are for rehab projects, and debt service coverage ratio (DSCR) loans are based on your rental income. Mortgages typically have 15- or 30-year terms, while hard money loans are more of a short-term solution for investors.

Why Hard Money Loans Are Popular in California

Account Assets Audit Bank Bookkeeping Finance Concept

California hard money loans are popular because they’re specifically designed to meet the needs of investors in competitive markets like Los Angeles, San Diego, and the Bay Area. It can take several weeks or even months to get approved for a traditional mortgage, and even longer to get your loan funded. Hard money loans offer a streamlined approval process and fast funding times, helping investors stay competitive in any market.

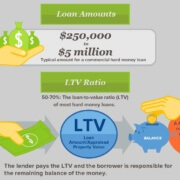

Hard money loans also offer more flexibility than traditional mortgages. California hard money lenders can be flexible on collateral requirements, plus they offer higher loan-to-value (LTV) and loan-to-cost (LTC) ratios. Hard money lenders are also willing to consider unique exit strategies when underwriting your loan.

How California Lenders Evaluate Hard Money Loan Applications

Hard money lenders in California focus on LTV and LTC when reviewing your loan application. The typical LTV cap for first mortgages is 70%, which means you can borrow up to 70% of the value of the property. LTC compares the loan amount to the cost of the project. These ratios protect lenders while giving borrowers the ability to leverage more equity.

Before you can get approved for a loan, you’ll need to have your property appraised. Appraisals help determine the value of the property you’re using as collateral. California hard money lenders will also make sure you have demonstrated experience in real estate investment before approving your loan application.

While hard money loans don’t have the strict credit score requirements traditional mortgages do, you typically need a credit score of at least 600 to get approved for a loan. In addition to credit score requirements, hard money lenders may also ask for rehab plans, rental projections and clear exit strategies. Selling or refinancing a property is an example of an exit strategy.

How We Selected the Best California Hard Money Lenders

When you’re looking at hard money lenders in California, it’s important to consider rates and fees, turnaround times, available loan programs and transparency. Here’s a breakdown of how we selected the best California hard money lenders:

- Rates and fees: Interest rates in the 8.99-13.99% range, origination fees around 2-3% to minimize the cost of your hard money loan.

- Turnaround time: Approval within 24-72 hours and funding within days to help investors stay competitive in hot markets.

- Loan programs: Various loan program options for residential fix-and-flip projects, new construction, and small commercial acquisitions.

- Transparency: Clear disclosure of points on a loan, interest-only terms, prepayment penalties and licensing status.

California hard money lenders who meet these requirements can help you finance your next real estate investment without unnecessary costs or added stress.

Top 10 California Hard Money Lenders Reviewed

1) Source Capital Funding, Inc.

Source Capital is the premier California-licensed direct lender with more than 40 years of combined experience and more than $550 million funded since 2007. From Los Angeles to the Bay Area, we’ve helped real estate investors throughout California secure funding for a range of projects and investments.

Source Capital can approve your loan in as little as 24 hours, and your loan will be funded in a matter of days. Interest rates range from 8.99-13.99% (depending on position) with origination fees around 2-3%, and there are no appraisal fees or prepayment penalties.

Our competitive loan terms have earned us an excellent reputation, with a 4.9-star Google rating on more than 350 reviews and an A+ BBB rating.

2) North Coast Financial

North Coast Financial has more than 40 years of experience as a California hard money lender, offering everything from land and construction loans to fix-and-flip and investment property loans. Loans are typically funded in 3–5 days, so you can start investing quickly.

Loan terms are typically 12 months at North Coast Financial, but loan terms are available up to 3–4 years.

3) Hard Money Lenders California

For 25 years, Hard Money Lenders California has been helping California real estate investors finance a variety of projects. Hard Money Lenders California offers fast turnaround times, with business purpose loans financed in as little as 24 hours.

Hard Money Lenders California is based in Newport Beach, making this lender an excellent choice if that’s where you’re looking to invest.

4) California Hard Money Direct

California Hard Money Direct has a solid reputation with more than 100 five-star reviews online. Hard money loans are available for both commercial and residential real estate, and you can receive pre-approval in a matter of minutes.

Loans are capped at 70% LTV, and you can track your loan online with Loan Track.

5) Lantzman Lending

Lantzman Lending offers loans ranging from $50,000 to $3 million, with loan terms ranging from 6–24 months. Interest rates start at 8.99%, with up to 65–70% ARV.

While Lantzman Lending doesn’t charge prepayment penalties, there is an origination fee that varies depending on the size and length of your loan.

6) PB Financial Group Corp

If you’re looking for an experienced lender who keeps things simple, PB Financial Group Corp is a solid choice. PB Financial Group Corp has been in business as a California hard money lender for 13 years, with more than 2,400 loans funded.

Loans can be closed in as little as 5 days, helping you stay competitive in the hot California real estate market.

7) Anchor Loans

Anchor Loans has a long history of empowering investors, with billions of dollars funded across more than 37,000 loans. If you’re looking to invest in other states as well, Anchor Loans has a presence in 48 states throughout the U.S.

Whether you’re developing land, building a house from the ground up or renovating a property, Anchor Loans can help.

8) Conventus LLC

Conventus LLC has a reputation for quick funding and clear terms, with more 244 loans originated in California. Loans are available with an LTV up to 65-70% and LTC up to 90% on eligible projects. Interest rates range from 9-12%.

You can get your loan approved through Conventus LLC in as little as 24 hours, with funding in 3-5 days after signing loan documents. Conventus loans also have minimal appraisal requirements and flexible exit options.

9) Center Street Lending

With 219 loans closed in California, Center Street Lending is another solid option for investors. Center Street Lending offers clear fee breakdowns and straightforward terms, with rates ranging from 8.5-11% and origination fees around 2%. LTV is capped at 70%.

Center Street Lending also offers one-year interest-only terms with easy extensions.

Common Mistakes When Choosing a California Hard Money Lender

Focusing Only on Interest Rates, Ignoring Points and Origination Fees

Hard money lenders in California don’t just vary in terms of interest rates; points and origination fees can also vary. Your loan cost is determined by interest rates, origination fees, and the amount you borrow. When you’re choosing a lender, look at the complete loan terms to find the best lender for your needs.

Overlooking Maximum LTV and Loan-to-Cost Ratios

Focusing on loan costs is important, but you should also consider LTV and LTC ratios. A lender with a slightly higher interest rate and an LTV cap of 70% might give you more leverage than a lender with a lower interest rate and a 60% LTV cap.

Neglecting Your Exit Strategy and Rehab Financing Plan

When you’re applying for a hard money loan in California, you should have a clear timeline for sale or refinance as well as detailed contractor budgets. Having a detailed rehab financing plan and exit strategy makes it easier to get approved for a loan.

Failing to Verify Lender Credentials and Licensing

Before you apply for a loan, confirm California Department of Financial Protection and Innovation (DFPI) licensing and BBB ratings. Avoid lenders who aren’t licensed or have poor BBB ratings.

Assuming All Lenders Offer the Same Turnaround Time

Hard money loan approval and funding times can range from 24 hours to a few weeks, so choose a lender whose approval and funding time fits your project.

Hard Money Lender Frequently Asked Questions

What Credit Score Is Required for Hard Money Loans?

Most hard money lenders in California require a credit score of at least 600, but some lenders have minimum credit score requirements as high as 620.

How Long Does a Hard Money Loan Take to Close?

Hard money loans typically close within 24-72 hours, with funding times ranging from 24 hours to two weeks.

Can I Use Hard Money to Finance Both Residential and Commercial Properties?

Absolutely. At Source Capital, we offer hard money loans for both residential investments and small commercial acquisitions.

What Fees Should I Expect (Origination Fee, Points, Interest-Only)?

Hard money loans typically have an origination fee of about 2-3%, although fees and loan terms vary by lender.

Is Hard Money Better Than a Traditional Bank Loan?

California hard money loans offer fast approval and funding times, making them a better alternative to traditional bank loans for many investors. Hard money loans also have less strict credit score and income requirements.

Conclusion: Top California Hard Money Lenders Reviewed

When it comes to hard money lenders in California, it’s hard to beat Source Capital. With more than $550 million funded and over 40 years of combined experience, Source Capital is the simple solution when you need financing for a real estate investment.

Finding loan features that fit your project, from approval and funding times to LTV and interest rates, is the key to a successful investment. Apply online or call (888) 249-9827 to get started today.