Google 5-Star Rated Direct Hard Money Lender

What is Loan to Value (LTV) and How to Calculate It

Loan to value (LTV) is a number lenders use to decide if they want to give you a loan for a house or other property. It’s a percentage that shows how much of the house’s value you’re borrowing. If this number is relatively low, it means you’re borrowing less compared to what the house is worth, which lenders prefer because it reduces their risk.

When considering taking out a loan, especially for something significant like buying a home or an investment property, you might come across various terms that can initially seem a bit confusing. One such term is loan to value. It’s a crucial concept that can impact the amount of loan you can secure and the interest rate you’ll be offered.

Understanding how lenders evaluate risk and determine loan amounts can help you make better financial decisions. Keep reading to learn about loan to value, how it’s calculated, and why it’s important.

- What is Loan to Value?

- How to Calculate Loan to Value

- What is a Good Loan to Value Ratio?

- Benefits of a Good LTV

- How to Lower Your LTV

- Loan to Value: FAQs

- Hard Money Loans with Fast & Easy Approvals

What is Loan to Value?

Loan to value is a lending metric used to assess the lender’s level of risk when they provide a loan. This number is essentially the percentage that tells you the ratio between the loan amount and the appraised value of the property or asset being financed.

Lenders use your loan to value ratio to calculate how much to lend and to set the terms of the loan, including the interest rate, down payment requirement, and the need for mortgage insurance. A higher LTV means you’ll need a higher loan amount, which results in more risk for the lender. If a borrower defaults, the lender may struggle to recoup their investment through the sale of the asset.

On the other hand, a lower loan to value ratio means the borrower has more equity, which reduces the lender’s potential losses if the property value declines.

Lenders often have maximum LTV thresholds for different loan types.

What is Combined Loan to Value?

While understanding the basic loan to value ratio is crucial, sometimes you may hear lenders use the term combined loan to value (CLTV). This concept is particularly important when you have multiple loans on a single property.

Combined loan to value determines the total value of all loans on a property in relation to its appraised value. Unlike the standard loan to value ratio, which only considers the primary mortgage, CLTV includes the primary mortgage as well as any additional loans secured by the property. This may include a second mortgage or a home equity line of credit (HELOC).

Lenders use CLTV alongside the standard loan to value ratio to assess risk and make lending decisions, especially when considering additional financing on a property with an existing mortgage.

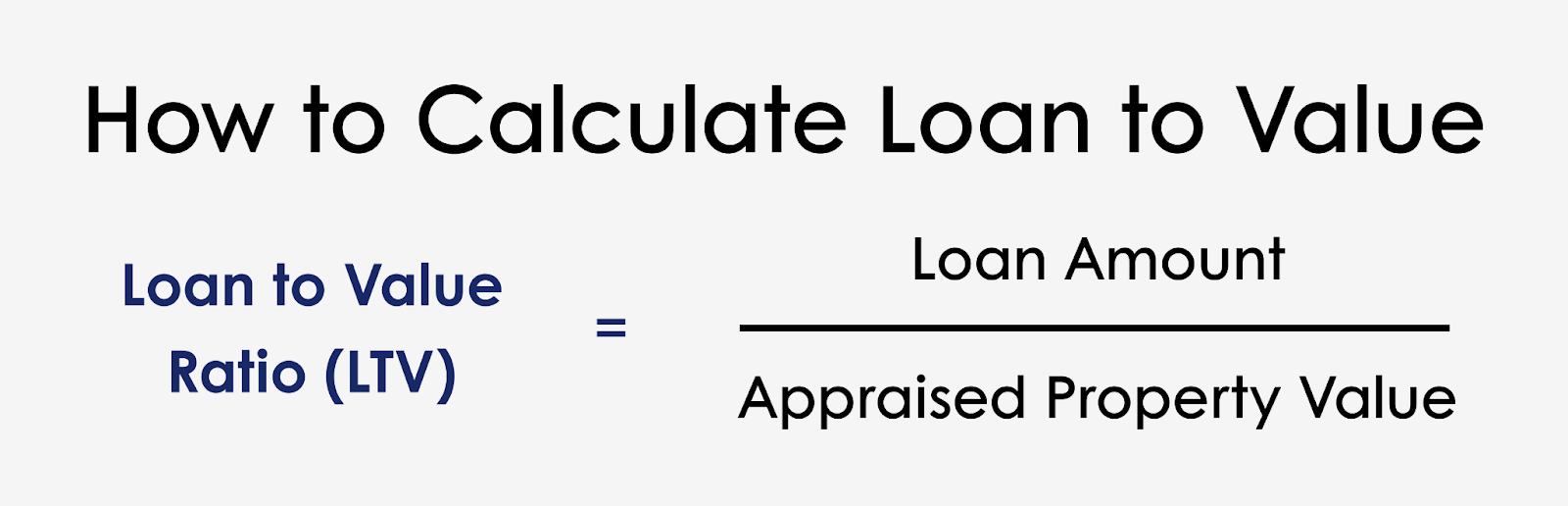

How to Calculate Loan to Value

The formula for calculating loan to value is:

Loan to value = (loan amount / appraised value of asset) x 100%

Here’s a breakdown of each component:

- Loan amount: This is the total amount of money you borrow from the lender.

- Appraised value of asset: This is the current market value of the property or asset as determined by a professional appraiser.

- The result is multiplied by 100 to express the ratio as a percentage.

Let’s say you want to purchase a home valued at $300,000, and you’re seeking a mortgage of $240,000.

- Loan amount: $240,000

- Appraised value of asset: $300,000

- Loan to value = ($240,000 / $300,000) x 100

- Loan to value = 0.80 x 100

- Loan to value = 80%

An LTV of 80% means you’re borrowing 80% of the home’s value and providing a 20% down payment.

How to Calculate Combined Loan to Value

Calculating the combined loan to value ratio is similar to standard LTV. The only difference is that you’re combining all loans associated with the property. The formula for calculating CLTV is:

CLTV = (sum of all loan balances / appraised property value) x 100%

Breaking this down:

- The sum of all loan balances: This includes the primary mortgage and any additional loans or lines of credit secured by the property

- Appraised property value: The current market value of the property

- The result is multiplied by 100 to express the ratio as a percentage.

For example, let’s say you have a property appraised at $400,000 with the following loans:

- Primary mortgage: $300,000

- Home equity line of credit: $50,000

- CLTV = ($300,000 + $50,000) / $400,000 x 100%

- CLTV = $350,000 / $400,000 x 100%

- CLTV = 0.875 x 100%

- CLTV = 87.5%

In this example, the combined loan to value ratio is 87.5%, which means the total of all loans against the property is 87.5% of its appraised value.

What is a Good Loan to Value Ratio?

What’s considered a good loan to value ratio depends on the lender and loan type. For conventional and bridge loans, a loan to value ratio of 80% or lower is generally considered good. This means that the loan amount is 80% or less of the property’s appraised value.

This lower loan to value ratio (or 20% down payment) often allows borrowers to avoid private mortgage insurance (PMI) and may qualify them for better interest rates.

However, what’s considered a good loan to value ratio can differ for various loan types:

- FHA loans: With these loans, you can make a down payment as little as 3.5%, allowing for a loan to value ratio of up to 96.5%.

- VA loans: These loans allow you to finance 100% of the home’s purchase price, giving you a 100% LTV ( no down payment).

- USDA loans: Similar to VA loans, the U.S. Department of Agriculture’s (USDA) loan program permits a 100% loan to value ratio (or more) for eligible rural homebuyers.

- Mortgage refinances: For most conventional refinances, a loan to value ratio of 80% or lower is ideal. This allows homeowners to avoid PMI and often qualifies them for the best rates.

It’s important to note that while these higher loan to value ratios make homeownership more accessible, they can also mean higher costs over the life of the loan due to larger loan amounts and potentially higher interest rates.

Benefits of a Good LTV

Understanding the benefits of a good LTV can help you see why lenders place such importance on this metric and why it’s beneficial to aim for a lower loan to value ratio when possible.

Easier Loan Approval

Lenders view a lower loan to value ratio favorably because it indicates less risk. When you have more equity in the property relative to the loan amount, lenders are more confident that you’ll repay the loan and are more likely to approve your application.

Better Loan Terms

A good loan to value ratio can often lead to more favorable loan terms. This may include longer repayment periods and lower fees. Lenders are typically more willing to offer flexible terms when they perceive the loan as less risky. For example, you might qualify for a 30-year fixed-rate mortgage instead of a shorter-term loan, which can make your monthly payments more manageable.

Lower Interest Rates

Lenders tend to give more competitive interest rates to borrowers with lower loan to value ratios because these loans are considered less risky. Even a small reduction in your interest rate can lead to substantial savings over the life of the loan.

Reduced Mortgage Insurance Requirements

For conventional loans, a loan to value ratio of 80% or lower typically means you can avoid paying private mortgage insurance. By avoiding this extra expense, you can lower your monthly payments and reduce the overall cost of your mortgage.

How to Lower Your LTV

If you’re looking to improve your LTV, there are several strategies you can try, such as:

Increase Your Down Payment

One of the most straightforward ways to lower your loan to value ratio is to make a larger down payment. By putting more money down upfront, you’re reducing the amount you need to borrow relative to the property’s value.

Choose a More Affordable Home

Another strategy to lower your loan to value ratio is to consider purchasing a less expensive property. By choosing a more affordable home, you can reduce the amount you need to borrow while potentially maintaining the same down payment amount.

For instance, if you have $60,000 for a down payment:

- On a $400,000 home, this would be a 15% down payment (85% LTV)

- On a $300,000 home, this would be a 20% down payment (80% LTV)

This approach can help you achieve a better loan to value ratio while staying within your budget.

Pay Down Your Loan’s Principal Balance

If you already have a mortgage, you can lower your loan to value ratio over time by paying down your loan’s principal balance. As you pay down your principal, your loan balance decreases while your home’s value potentially increases, improving your loan to value ratio.

Loan to Value: FAQs

Is LTV the only factor lenders consider?

No, loan to value is not the only lending criteria considered. While LTV is important, lenders typically consider a range of factors to assess the overall risk of a loan.

Conventional loan lenders generally consider the following:

- Credit score:

- Income

- Debt-to-income ratio

- Employment history

Hard money lenders, like Source Capital, often have different priorities. They typically focus more on:

- The value of the property serving as collateral

- The potential profitability of the investment (for real estate investors)

- The borrower’s experience in real estate investing

- Exit strategy for repaying the loan

Can my LTV ratio change over time?

Yes, your loan to value ratio can change over time. This can occur due to:

- Paying down your loan principal, which decreases your loan balance

- Changes in your property’s market value

- Taking out additional loans against the property

These changes in your LTV ratio can affect your ability to refinance your loan. A lower LTV ratio may qualify you for better refinancing terms, while a higher LTV might limit your refinancing options.

How do lenders verify property value for LTV calculations?

Lenders typically rely on a professional appraisal to determine the property’s market value for LTV calculations. A licensed appraiser will assess the property, considering recent sales of comparable properties in the area, the property’s condition and features, and current market trends.

Hard Money Loans with Fast & Easy Approvals

Source Capital offers same-day approvals and can close loans in as little as 7-10 days. Whether you’re looking to finance residential, commercial, or industrial properties, hard money loans can provide the capital you need.

At Source Capital, we offer hard money loans in California, Arizona, Colorado, Minnesota, and Texas, offering a streamlined application process and competitive terms for real estate investors and property owners seeking alternative financing solutions. Apply now!