Google 5-Star Rated Direct Hard Money Lender

What Are Flip and Fix Loans & How Do They Work?

Flip and fix loans can help real estate investors maximize their returns through property flipping. These mortgage loans cater to the unique needs of investors who purchase distressed or undervalued properties, renovate them to enhance market value, and quickly sell them for a profit.

Flip and fix loans provide short-term financing for property acquisition and renovation to help investors capitalize on opportunities. Whether you’re new to real estate investing or expanding your portfolio, knowing how fix and flip loans work can help you determine whether they’re the right option for you.

Keep reading to learn more about these loans, how they work, the types available, and how you can use them to successfully invest in real estate.

- What is a Flip and Fix Loan?

- Types of Flip and Fix Loans & How They Work

- Benefits of Flip and Fix Loans

- Flip and Fix Loan Tips & Strategies

- Flip and Fix Loans: FAQs

- Achieve Your Real Estate Investment Goals

What is a Flip and Fix Loan?

A flip and fix loan is a specialized type of real estate financing used to purchase properties, fix or renovate them, and sell them quickly for a profit — a practice known as house flipping. These property loans provide investors with the funds to acquire properties that may not qualify for traditional financing. Covering both the purchase and renovation costs, these loans allow investors to quickly improve the property’s market value.

Fix and flip financing is ideal for investors who want to flip properties. If you’re someone who sees potential in distressed homes or undervalued properties that need a bit of TLC, these loans can help you turn a profit. They’re especially helpful if you want to quickly buy, renovate, and sell homes to capitalize on market opportunities.

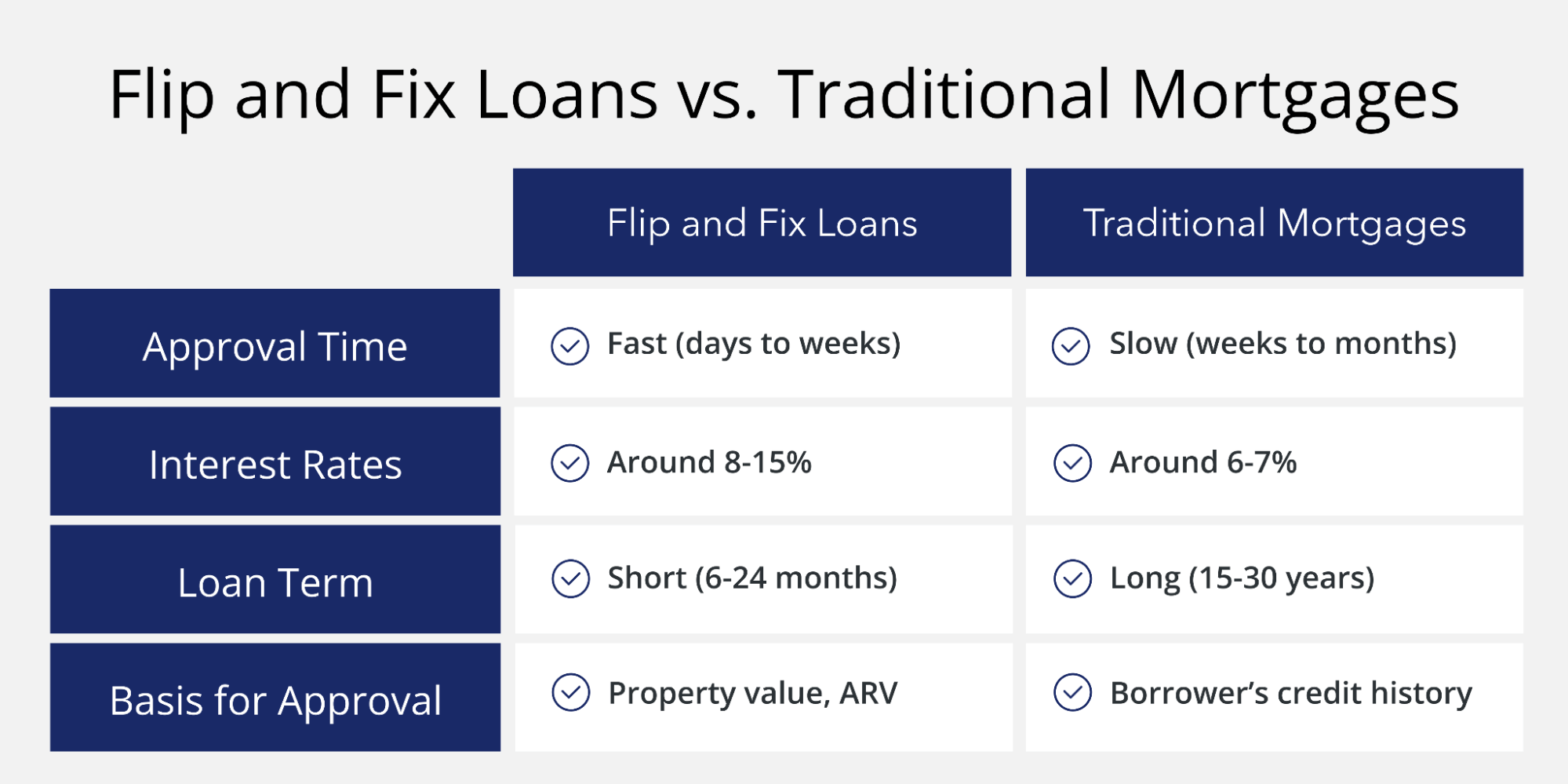

Real estate investors often turn to flip and fix loans because they offer flexibility and speed. Unlike conventional mortgages, which may have more stringent requirements and longer processing times, flip and fix loans are designed for rapid turnaround. This allows investors to find ways to purchase properties at lower prices, renovate them to increase their appeal and value, and sell them at a higher price in a relatively short period.

Keep in mind that flip and fix loans are short-term. If you’re looking for a longer-term loan for rental properties, you might consider a DSCR loan, which focuses on property value appreciation and rental income potential rather than how much the property will sell for.

Additionally, flip and fix loans are not intended for borrowers looking to purchase a property to live in and renovate as their primary residence. These loans are specially geared toward investors focused on property flipping for profit rather than personal occupancy.

Types of Flip and Fix Loans & How They Work

Let’s take a look at the different types of fix and flip loans investors can tap into. Each option offers benefits and considerations, so it’s important to understand how they work. The most common flip and fix loan programs are:

Hard Money Loans

Hard money fix and flip loans are offered by private lenders like Source Capital or investors who are less concerned about your credit score and more interested in the property’s potential. These loans offer speed and flexibility, making them perfect for investors looking for lucrative real estate opportunities that require fast funding.

Home Equity Loans & HELOCs

These types of home equity loans allow you to borrow against the value of equity built up in your home or another property you own. The main difference between the two is that with a home equity loan, you’ll get a lump sum.Meanwhile, with a home equity line of credit (HELOC), you’ll get a revolving line of credit.

Both options generally feature lower interest rates compared to hard money loans but require using your home as collateral.

Government-Backed Loans

- More info here: https://www.capcenter.com/learning/mortgages/fha-flip-rule

Seller Financing

In seller financing, the property owner acts as your lender. This arrangement can benefit both parties, offering flexibility and potentially speeding up the buying process. Seller financing is best when the seller is motivated to sell and willing to negotiate financing terms directly.

401(k) Loans

Investors may also consider borrowing from their 401(k) retirement savings for flip projects. This option allows access to funds without penalties, provided repayment terms are met. However, you should consider potential drawbacks, such as the impact this will have on your retirement savings and the risk of incurring taxes or penalties if repayment schedules aren’t strictly followed.

Traditional Bank Loans

Traditional bank loans provide stability with lower interest rates for investors with strong credit histories. They require meeting stringent eligibility criteria and are suitable for established investors looking for competitive financing options.

Benefits of Flip and Fix Loans

Understanding the advantages of flip and fix loans can help you maximize profitability when flipping homes. Here are a few reasons these loans are beneficial for real estate investors:

Less Stringent Credit Requirements

Unlike traditional loans, flip and fix financing often prioritizes the property’s potential rather than the borrower’s credit history. This flexibility allows investors with less-than-perfect credit to secure funding for their projects more easily.

Quick Access to Capital

Speed is critical when you’re a flipper, allowing you to take advantage of opportunities as quickly as they arise. Flip and fix loans provide rapid access to funds. Private lenders typically streamline approval processes, allowing investors to capitalize on time-sensitive opportunities without delays.

Improved Cash Flow

With flip and fix loans, investors can manage cash flow during property renovations more efficiently. These loans cover the purchase and renovation costs upfront, minimizing out-of-pocket expenses and optimizing financial liquidity throughout the project, meaning you’ll have more cash on hand.

Potential for High Returns

One of the primary reasons investors use flip and fix loans is their potential for significant returns on investment. Investors can sell renovated homes at higher prices by revitalizing distressed properties and increasing their market value, maximizing their profitability from each flip.

Flip and Fix Loan Tips & Strategies

To be a successful flipper, you’ll need a strategy. Here are a few tips to help you maximize your investment potential:

Choose the Right Lender

Your lender can greatly impact your flip project because their interest rates, loan terms, and fees directly influence profitability and timeline, making it essential to find a lender who offers the best terms and efficient processing.

Compare interest rates, terms (such as repayment periods and flexibility), and fees (including origination fees and closing costs). Source Capital offers hard money flip and fix loans with quick approval and funding processes, which is ideal for time-sensitive projects.

Conduct a Detailed Property Inspection

Before committing to renovations, conduct a property inspection. Evaluate the property’s structural integrity to determine any underlying issues that may affect renovation costs and timeline. Estimating repair expenses and assessing potential resale value are crucial for budgeting and profitability.

Create a Comprehensive Plan

Developing a thorough renovation plan can help you succeed. Divide tasks into manageable phases, establish realistic timelines for each phase, and budget for materials, labor, and unforeseen expenses.

Consider getting multiple quotes from contractors and suppliers to ensure cost efficiency.

Maximize Renovation Impact

Focus on renovations that maximize property value. Upgrade high-impact areas like kitchens and bathrooms, which are key selling points for buyers. You should also enhance curb appeal by investing in landscaping and exterior improvements.

Use quality materials that balance cost-effectiveness with durability to appeal to prospective buyers and ensure long-term satisfaction.

Flip and Fix Loans: FAQs

What do I need to qualify for a flip and fix loan?

For these loans, lenders place less emphasis on credit scores. Instead, they focus more on fix and flip loan requirements like the value of the property and the borrower’s experience in real estate investments, particularly house flipping.Typically, lenders focus on the property’s potential after renovation and the borrower’s ability to execute the project successfully.

How much can I borrow with a flip and fix loan?

The amount you can borrow with a flip and fix loan depends on many factors, such as the property’s after-repair value (ARV) and the lender’s loan-to-value (LTV) ratio. Generally, lenders may finance up to 70-90% of the ARV.

How quickly can I get approved for a flip and fix loan?

Approval for a hard money flip and fix loan can be quick, often within days. This rapid approval process is one of the many benefits of working with a hard money lender who prioritizes the property value and borrower experience over credit checks.

What kind of properties can I purchase with a flip and fix loan?

Flip and fix loans are used for distressed or undervalued properties requiring renovation to increase their market value. The types of properties you can use this loan for can range from single-family homes to multi-unit residential or even commercial buildings.

Can I use a flip and fix loan for multiple properties at once?

Yes, experienced investors with a proven track record and enough collateral may qualify to use flip and fix loans for multiple properties at the same time. Lenders will assess each property’s potential and the borrower’s ability to manage multiple projects simultaneously.

Achieve Your Real Estate Investment Goals

Source Capital provides hard money loans tailored for real estate investors who want to purchase, fix or renovate, andsell properties. Our hard money loans in California, Minnesota, Colorado, Arizona, and Texas are designed for quick access to funds without prepayment penalties, making them ideal for flippers with varying credit histories or unconventional income sources.

We understand how time-sensitive flip projects can be. Our streamlined approval process ensures rapid funding so that you can act quickly on promising deals. Apply now or contact us to learn about the different financing options available for investors.